Artificial Intelligence in Chemicals Market to Surpass USD 28 Billion by 2034 as Digital Twins and Sustainability Drive Transformation

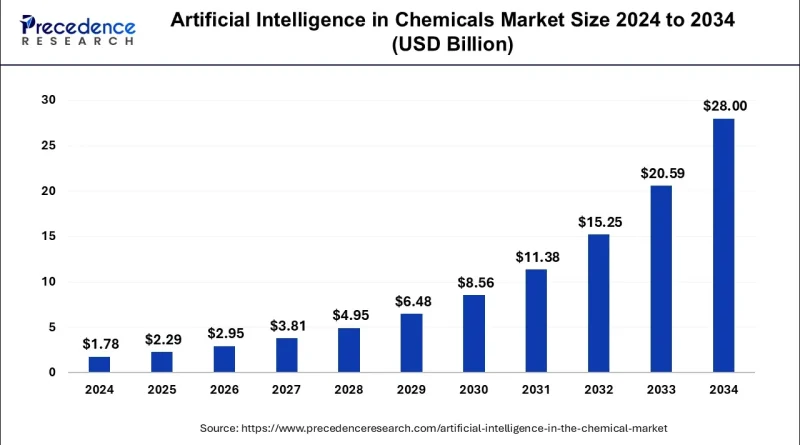

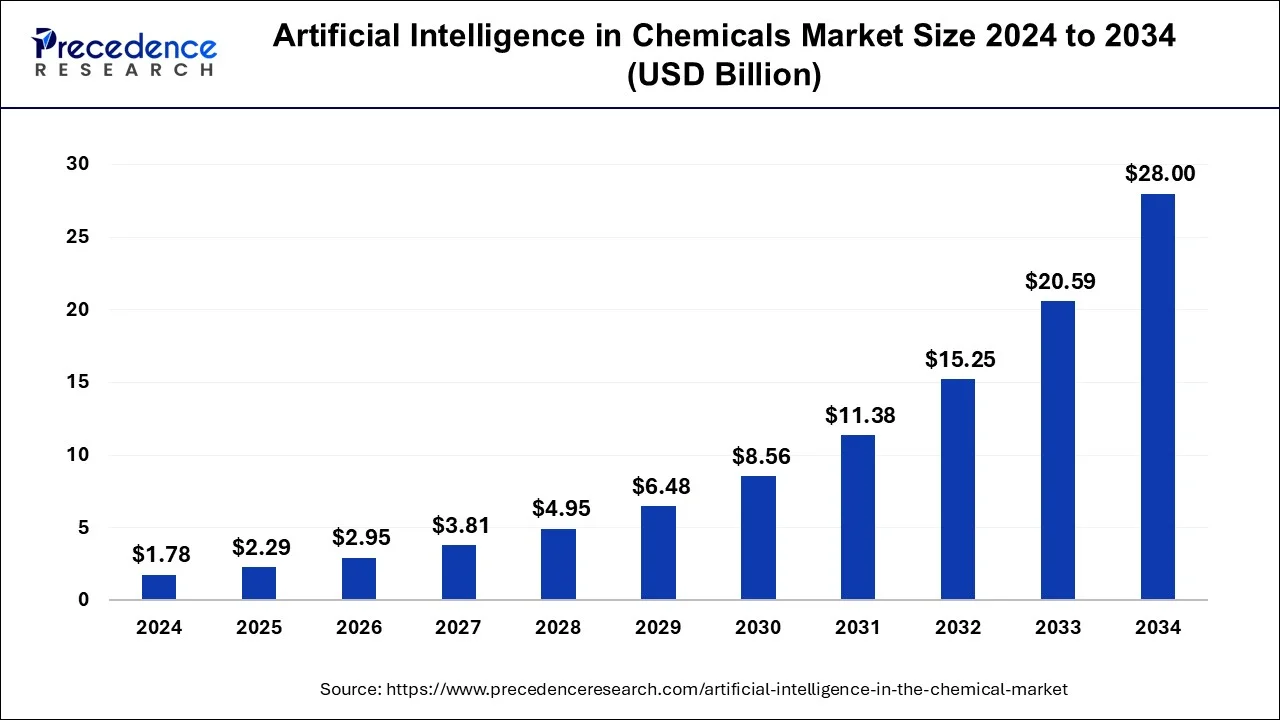

According to Precedence Research, the global artificial intelligence (AI) in chemicals market is set for explosive growth, projected to expand from USD 2.29 billion in 2025 to nearly USD 28 billion by 2034, at a remarkable CAGR of 32.05%. This surge reflects how AI is reshaping the chemical industry through process optimization, predictive maintenance, digital twins, accelerated material discovery, and sustainability-focused solutions.

Key Market Takeaways

-

Market size: USD 2.29 billion in 2025 → USD 28 billion by 2034.

-

Growth rate: CAGR of 32.05% (2025–2034).

-

Regional dominance: North America led with 39.4% share in 2024.

-

Segment insights:

-

By Type: Services led in 2024 (40.22% share).

-

By End-Use: Base chemicals & petrochemicals will command 57.5% share by 2034.

-

By Application: Discovery of new materials and production optimization are the fastest-growing.

-

🌍 Market Overview: Why AI Matters in Chemicals

Artificial Intelligence is no longer a buzzword in chemicals—it is a competitive necessity. AI solutions enable:

-

Smart Manufacturing: Digital twins and automation reduce downtime and improve real-time control.

-

Predictive Maintenance: Machine learning forecasts equipment failures before they happen, cutting costly disruptions.

-

Material & Drug Discovery: Generative AI accelerates molecular design, reducing R&D timelines by years.

-

Sustainability: AI helps reduce emissions, optimize energy use, and design greener chemical alternatives.

For instance, SABIC’s predictive maintenance initiative in 2024 saved an estimated USD 107,000 in downtime losses during a single event, while also cutting energy waste and aligning with sustainability targets.

Why AI is Becoming a Game-Changer in Chemicals

The chemical industry, historically reliant on capital-intensive infrastructure and trial-and-error experimentation, is undergoing a digital shift. Artificial intelligence introduces automation, real-time monitoring, and advanced analytics, which together improve efficiency, lower costs, and reduce waste.

One of the biggest breakthroughs is the use of digital twins—AI-driven virtual models of chemical plants that simulate real-time operations. These systems allow engineers to test changes before implementation, preventing costly downtime. Companies like SABIC have already seen remarkable benefits. In 2024, its AI-powered predictive maintenance systems prevented losses of more than USD 107,000 during a single incident, while improving energy efficiency and asset reliability.

AI is also powering faster material and drug discovery. Generative AI algorithms can predict molecular structures and properties before they are tested in the lab, significantly reducing research and development timelines. For the pharmaceutical and agrochemical industries, this means quicker routes to market and more effective compounds.

Perhaps most importantly, AI is enabling sustainability in the chemical sector. By minimizing energy consumption, cutting emissions, and optimizing resource use, AI solutions support green chemistry initiatives and regulatory compliance, aligning the industry with global environmental goals.

Browse More Insights@ https://www.precedenceresearch.com/artificial-intelligence-in-the-chemical-market

Regional Insights: Where AI Adoption is Accelerating

North America has been the clear leader in AI adoption within chemicals, holding a 39.4% share in 2024. The United States alone was valued at USD 630.29 million in 2024, and is forecast to reach USD 9.05 billion by 2034 at a robust 30.9% CAGR. The region benefits from advanced R&D infrastructure, strong government support for AI initiatives, and the presence of leading chemical and technology companies.

In contrast, Europe is emerging as the fastest-growing region, fueled by the European Union’s Green Deal and its emphasis on sustainable, energy-efficient manufacturing. The continent’s strong focus on green chemistry and the replacement of toxic substances aligns perfectly with AI’s ability to model safer alternatives and streamline production.

Meanwhile, Asia-Pacific is set to become a powerhouse in AI-driven chemical manufacturing. Countries like China, Japan, and India are investing heavily in AI-powered smart factories, digital R&D hubs, and large-scale production systems, making the region a hotbed for innovation.

Trends Reshaping the Chemical Industry with AI

Several key trends are setting the tone for the next decade:

-

Generative AI in Molecular Design – AI-driven molecular simulations are making it possible to test thousands of compounds virtually, reducing R&D cycles.

-

Digital Twins and Smart Manufacturing – Virtual replicas of plants enable real-time monitoring and predictive adjustments to maintain efficiency.

-

Predictive Maintenance – AI models prevent equipment breakdowns, extending asset lifespans and lowering repair costs.

-

Energy Efficiency and Sustainability – AI algorithms optimize energy usage, reduce waste, and align production with ESG goals.

-

Drug and Agrochemical Discovery – AI accelerates the development of pharmaceuticals and crop-protection products, cutting costs and timelines.

Segment Analysis: Who Benefits the Most?

-

By Type:

The services segment dominated in 2024, as chemical companies increasingly seek consulting and integration support to implement AI. However, the software segment is projected to grow the fastest, as demand for high-performance AI platforms in drug discovery and material research accelerates. -

By Application:

The discovery of new materials segment was the largest in 2024, helping scientists explore vast chemical spaces and design novel compounds without relying solely on physical testing. Looking ahead, production optimization will be the fastest-growing application, as manufacturers leverage AI to reduce waste, cut energy costs, and maintain consistent product quality. -

By End-Use:

The base chemicals and petrochemicals sector held the dominant share in 2024 and is projected to account for 57.5% of the market by 2034. Large-scale, asset-heavy operations stand to gain the most from AI-enabled predictive maintenance and process control.

Case Study: SABIC’s AI Transformation

SABIC, one of the largest chemical producers globally, illustrates how AI can transform operations. By adopting AI-powered monitoring systems across multiple plants, SABIC was able to:

-

Predict equipment failures before they occurred.

-

Implement digital twins for simulating plant behavior and testing virtual scenarios.

-

Reduce downtime, improve energy efficiency, and enhance sustainability metrics.

This real-world example highlights why predictive maintenance and process optimization are expected to remain among the fastest-growing applications of AI in the chemical industry.

Also Read@ Artificial Intelligence in Healthcare Market to Transform Global Care Delivery

Competitive Landscape

The AI in chemicals market is highly competitive, with both chemical giants and technology providers driving innovation. Major players include:

Manuchar N.V., IMCD N.V., Univar Solutions Inc., Brenntag S.E., Sojitz Corporation, ICC Industries Inc., Azelis Group NV, Tricon Energy Inc., Biesterfeld AG, Omya AG, HELM AG, Sinochem Corporation, Petrochem Middle East FZE.

Recent developments further validate the market’s growth trajectory:

-

In April 2025, the Icahn School of Medicine at Mount Sinai launched an AI-based small-molecule drug discovery center.

-

In March 2025, a U.K. start-up announced its mission to identify new chemicals and materials using AI, recruiting leading scientists and AI pioneers.

-

The University of Tulsa integrated AI into its chemical engineering curriculum, preparing the next generation of chemical engineers for AI-driven innovation.

Outlook: The Future of AI in Chemicals

The next decade will be defined by how effectively chemical companies embrace digital transformation. AI will move from pilot projects to being embedded in every stage of production, supply chains, and R&D pipelines. Companies that integrate AI early will gain a competitive edge in cost efficiency, sustainability, and innovation.

By 2034, the chemical industry will look drastically different—powered by digital twins, cloud-based AI platforms, and sustainability-first processes. For stakeholders, this is not just a growth opportunity; it is a chance to lead the next wave of chemical innovation.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Artificial Intelligence (AI) in Chemicals Market Table of Contents

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Artificial Intelligence (AI) in the Chemical Market

5.1. COVID-19 Landscape: Artificial Intelligence (AI) in the Chemical Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Artificial Intelligence (AI) in the Chemical Market, By Type

8.1. Artificial Intelligence (AI) in the Chemical Market, by Type

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast

8.1.2. Software

8.1.2.1. Market Revenue and Forecast

8.1.3. Services

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Artificial Intelligence (AI) in the Chemical Market, By Application

9.1. Artificial Intelligence (AI) in the Chemical Market, by Application

9.1.1. Molecule Design

9.1.1.1. Market Revenue and Forecast

9.1.2. Retrosynthesis

9.1.2.1. Market Revenue and Forecast

9.1.3. Reaction Outcome Prediction

9.1.3.1. Market Revenue and Forecast

9.1.4. Reaction Conditions Prediction

9.1.4.1. Market Revenue and Forecast

9.1.5. Chemical Reaction Optimization

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Artificial Intelligence (AI) in the Chemical Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type

10.1.2. Market Revenue and Forecast, by Application

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type

10.1.3.2. Market Revenue and Forecast, by Application

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type

10.1.4.2. Market Revenue and Forecast, by Application

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type

10.2.2. Market Revenue and Forecast, by Application

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type

10.2.3.2. Market Revenue and Forecast, by Application

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type

10.2.4.2. Market Revenue and Forecast, by Application

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type

10.2.5.2. Market Revenue and Forecast, by Application

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type

10.2.6.2. Market Revenue and Forecast, by Application

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type

10.3.2. Market Revenue and Forecast, by Application

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type

10.3.3.2. Market Revenue and Forecast, by Application

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type

10.3.4.2. Market Revenue and Forecast, by Application

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type

10.3.5.2. Market Revenue and Forecast, by Application

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type

10.3.6.2. Market Revenue and Forecast, by Application

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type

10.4.2. Market Revenue and Forecast, by Application

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type

10.4.3.2. Market Revenue and Forecast, by Application

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type

10.4.4.2. Market Revenue and Forecast, by Application

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type

10.4.5.2. Market Revenue and Forecast, by Application

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type

10.4.6.2. Market Revenue and Forecast, by Application

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type

10.5.2. Market Revenue and Forecast, by Application

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type

10.5.3.2. Market Revenue and Forecast, by Application

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type

10.5.4.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. Manuchar N.V

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. IMCD N.V.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Univar Solutions Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Brenntag S.E.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Sojitz Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ICC Industries Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Azelis Group NV

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Tricon Energy Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Biesterfeld AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Omya AG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

- Case Study: SABIC – Predictive Maintenance and AI-Driven Operational Excellence - August 19, 2025

- Case Study: BASF – AI-Driven Material Discovery - August 19, 2025

- Artificial Intelligence in Chemicals Market to Surpass USD 28 Billion by 2034 as Digital Twins and Sustainability Drive Transformation - August 19, 2025