GLP-1 Analogues Market Set to Surpass USD 879.9 Billion by 2034, Driven by Rising Diabetes and Obesity Rates

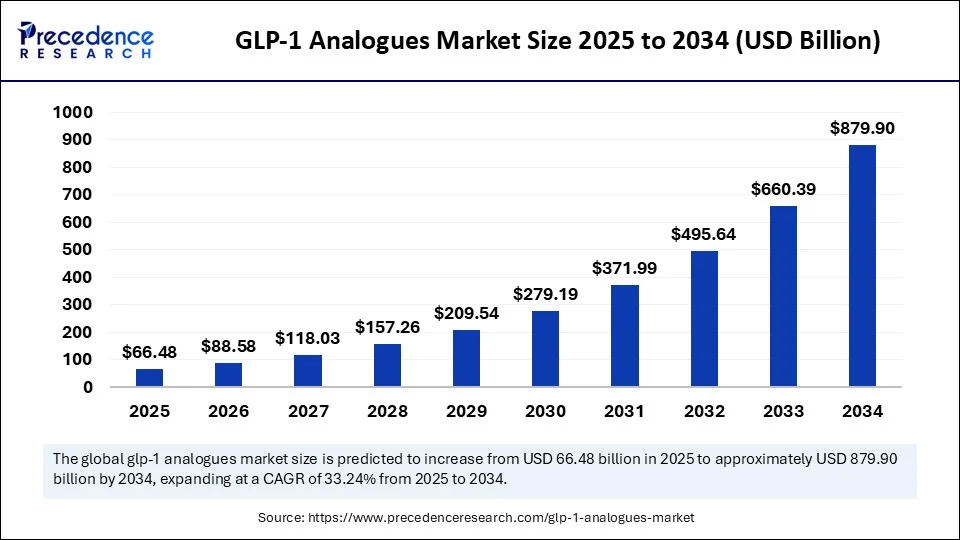

The global GLP-1 analogues market is entering a new era of growth. Valued at USD 49.90 billion in 2024, the market is expected to expand from USD 66.48 billion in 2025 to nearly USD 879.90 billion by 2034, registering a powerful CAGR of 33.24% between 2025 and 2034.

This extraordinary growth is being fueled by the rising burden of type 2 diabetes and obesity worldwide, alongside the rapid adoption of next-generation GLP-1 therapies that are transforming how these chronic conditions are treated.

GLP-1 Analogues Market Highlighs:

- In terms of revenue, the global GLP-1 analogues market was valued at USD 49.90 billion in 2024.

- It is projected to reach USD 879.90 billion by 2034.

- The market is expected to grow at a CAGR of 33.24% from 2025 to 2034.

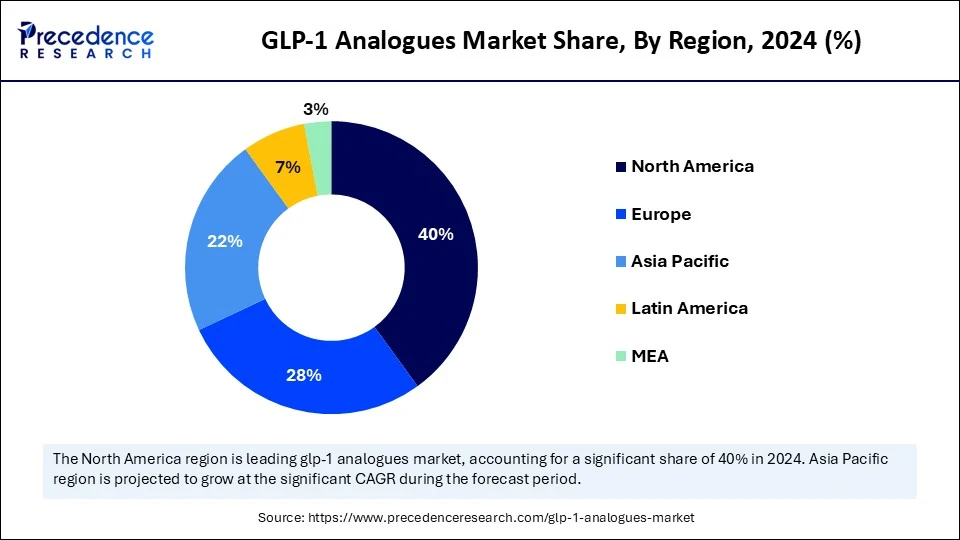

- North America dominated the GLP-1 analogues market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product type, the injectable GLP-1 analogues segment held the biggest market share of 70% in 2024.

- By product type, the oral GLP-1 segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the type 2 diabetes mellitus segment captured the highest market share of 60% in 2024.

- By application, the obesity management segment is projected to grow at the fastest CAGR during the forecast period.

- By route of administration, the subcutaneous injection segment contributed the highest market share of 75% in 2024.

- By route of administration, the oral administration segment is the fastest growing during the forecast period.

- By distribution channel, the hospital pharmacies segment generated the major market share of 50% in 2024.

- By distribution channel, the online pharmacies segment is emerging as the fastest-growing during the forecast period.

Why Are GLP-1 Analogues Becoming So Important?

GLP-1 (glucagon-like peptide-1) analogues are no longer viewed as specialized treatments for diabetes. Instead, they have become mainstream therapies because they address two of the most critical health challenges of the modern era—diabetes and obesity. These drugs not only improve blood sugar control but also contribute significantly to weight loss, which makes them highly attractive in a world where obesity rates are surging at alarming levels.

Beyond these core benefits, GLP-1 analogues also offer cardiovascular protection, positioning them as multi-purpose therapies that reduce long-term healthcare risks and costs. This versatility explains why they are being embraced by physicians, patients, and policymakers alike.

What Is Driving the Market Forward?

The momentum of the GLP-1 market is the result of several overlapping forces. First, the global rise in obesity and diabetes cases has created an urgent demand for effective treatment options that go beyond traditional therapies. Second, healthcare providers in developed regions have been quick to adopt innovative GLP-1 therapies, thanks to well-established infrastructure and reimbursement frameworks.

At the same time, continuous investments in research and development are producing next-generation formulations, including oral alternatives and combination therapies that promise superior outcomes. Together, these elements are creating an environment where GLP-1 therapies are not just an option, but increasingly a necessity in modern healthcare.

What Are the Key Benefits of GLP-1 Therapies?

The benefits of GLP-1 therapies extend well beyond blood sugar control. One of the most compelling advantages is their ability to promote weight loss, a factor that has elevated their role from being “diabetes drugs” to “metabolic health solutions.” In addition, clinical studies show that GLP-1 analogues offer cardiovascular protection, which reduces the risk of heart disease in at-risk patients.

For healthcare providers, this means better patient outcomes and reduced long-term costs, while for patients, it means greater convenience and quality of life. These multiple benefits explain why adoption is surging across both diabetic and non-diabetic populations.

What Challenges Could Slow Market Growth?

Despite their remarkable promise, the GLP-1 analogues market is not without obstacles. One of the most pressing issues is affordability. These therapies remain significantly more expensive than traditional treatments, making them inaccessible to many patients in low- and middle-income regions. Even in developed markets, insurance coverage is inconsistent, creating barriers to adoption.

Another challenge lies in accessibility. Distribution gaps in emerging markets limit patient reach, while side effects such as gastrointestinal discomfort have caused concerns over long-term adherence. Finally, competition from generics and alternative therapies could pressure market leaders to rethink pricing and strategy. Unless these challenges are addressed, growth could face bottlenecks in certain regions.

What Does the Future Hold?

The future of GLP-1 therapies extends well beyond diabetes management. Increasingly, clinical trials are focusing on applications in obesity, cardiovascular disease, and other metabolic disorders. This expansion into new therapeutic areas opens up multi-billion-dollar opportunities.

The next decade will likely see a stronger shift toward oral formulations that improve patient convenience and compliance. Additionally, the integration of GLP-1s with digital health platforms and telemedicine solutions will drive adherence and improve outcomes. The rise of precision medicine will also enhance personalization, ensuring that treatments are tailored to individual patient needs.

GLP-1 Analogues Market Report Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 879.90 Billion |

| Market Size in 2025 | USD 66.48 Billion |

| Market Size in 2024 | USD 49.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 33.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

View Full Report@ https://www.precedenceresearch.com/glp-1-analogues-market

Why Did North America Dominate the GLP-1 Market in 2024?

In 2024, North America emerged as the global leader in the GLP-1 market. Several factors explain this dominance. The region faces some of the highest obesity and diabetes rates in the world, creating immense demand for effective treatments. At the same time, advanced healthcare systems and insurance reimbursement structures ensure wide patient access.

Moreover, physician awareness is high, and public understanding of weight management and cardiometabolic health is increasing. With continuous product launches and a stable regulatory framework, North America has firmly established itself as the epicenter of GLP-1 innovation and adoption.

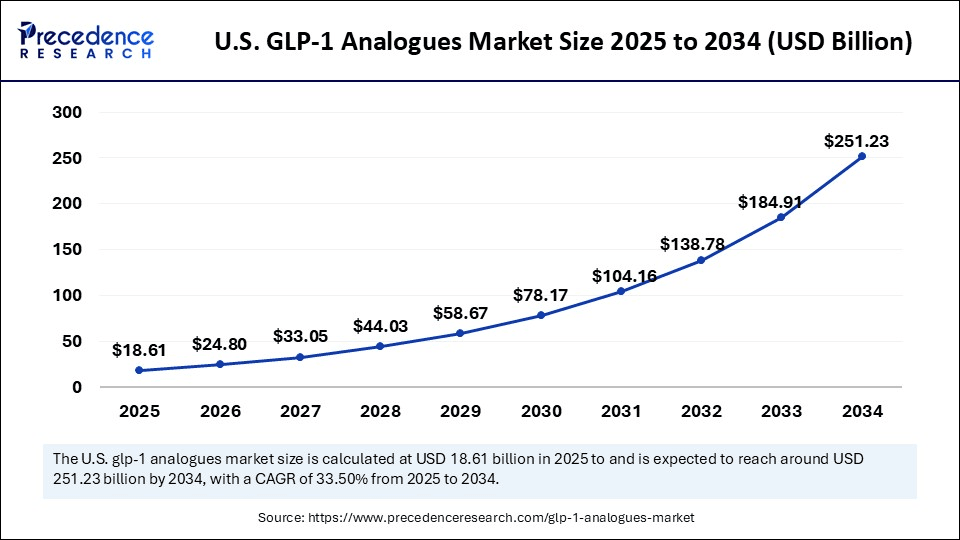

How Big Is the U.S. GLP-1 Market?

The U.S. market is particularly noteworthy. In 2024, it was valued at USD 13.97 billion, and it is projected to grow to USD 251.23 billion by 2034, expanding at a CAGR of 33.50%. This remarkable growth is fueled by FDA approvals for obesity indications, the surge in patient demand, and ongoing investments in drug development.

In addition, the rise of digital health channels, telehealth consultations, and online pharmacies is revolutionizing how patients access GLP-1 therapies, making them more convenient and widely available.

Why Is Asia-Pacific the Fastest-Growing Region?

While North America currently dominates, Asia-Pacific is expected to be the fastest-growing region through 2034. The region faces a skyrocketing incidence of diabetes and obesity, largely due to urbanization and lifestyle changes. At the same time, healthcare infrastructure is expanding, and middle-class populations are increasingly seeking advanced therapies.

Governments in India, China, and Southeast Asia are also investing heavily in diabetes management initiatives, creating favorable conditions for adoption. Coupled with growing affordability and awareness, Asia-Pacific is rapidly emerging as the strongest growth engine for GLP-1 therapies worldwide.

What’s Driving Growth in India?

India is a standout story in the Asia-Pacific market. The country is witnessing a sharp rise in both obesity and type 2 diabetes cases, driven by urban lifestyles and dietary shifts. Patients are becoming more aware of cutting-edge therapies, and private healthcare systems are expanding their capabilities.

Although injectables dominate today, oral GLP-1 therapies are gaining strong momentum as patients increasingly demand convenience and needle-free options. With multinational pharmaceutical companies investing in the Indian market and digital health platforms improving access, India is set to be a critical growth hub for GLP-1 therapies in the coming decade.

Why Did Injectable GLP-1 Analogues Dominate in 2024?

Injectables accounted for the largest share of the market in 2024. Their dominance stems from proven clinical efficacy, physician trust, and strong reimbursement structures. These therapies are well-established as the standard of care for type 2 diabetes, with a strong record in both blood sugar control and cardiovascular safety.

That said, oral GLP-1s are the fastest-growing segment, thanks to improvements in drug delivery technologies and increasing patient preference for convenience. Over time, this category could significantly reshape market dynamics.

Why Did Type 2 Diabetes Lead in 2024?

Type 2 diabetes was the largest application segment in 2024. The widespread adoption of GLP-1 analogues for blood sugar control and their inclusion in clinical guidelines ensured strong demand. Their ability to reduce long-term complications further reinforced their dominance in this category.

However, obesity management is rapidly gaining ground. Clinical evidence of weight loss, combined with regulatory approvals and payer recognition of obesity as a treatable chronic condition, is fueling adoption. The shift toward obesity care is likely to redefine the market in the coming years.

Why Are Subcutaneous Injections Still Preferred?

Subcutaneous injections remain the preferred route of administration because they deliver proven results and enjoy strong physician confidence. Once-weekly formulations have improved patient adherence, and the healthcare infrastructure to support injectable delivery is already well established.

At the same time, oral formulations are quickly gaining momentum. Their convenience and non-invasive nature make them highly attractive to patients, and advances in bioavailability are making them more effective than ever before.

Why Do Hospital Pharmacies Lead Distribution?

Hospital pharmacies currently lead distribution because they play a central role in managing chronic disease patients. They ensure adherence, coordinate with physicians, and negotiate directly with manufacturers, which guarantees stable supply and competitive pricing.

However, online pharmacies are the fastest-growing channel. Driven by telemedicine, digital adoption, and patient demand for home delivery, they are reshaping the way GLP-1 therapies are distributed. Subscription models and mobile health platforms are accelerating this trend, making online channels a major growth driver.

Also Read@ Surgical Snare Market: How AI and Minimally Invasive Surgery Are Shaping the Future

GLP-1 Analogues Market Top Companies

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- AstraZeneca

- Boehringer Ingelheim

- Pfizer

- Amgen

- Roche

- Zealand Pharma

- Structure Therapeutics

- Viking Therapeutics

- Hangzhou Sciwind Biosciences

- Fudan University

- Eccogene

- Medtronic

- Merck & Co.

- AbbVie

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Boehringer Ingelheim

GLP-1 Analogues Market Concentration and Ecosystem Analysis

Market Concentration: A Duopoly at the Core

The GLP-1 analogues market is highly concentrated, with the majority of global revenues controlled by two dominant players—Novo Nordisk and Eli Lilly and Company.

Novo Nordisk is a pioneer in the space, with blockbuster drugs such as Ozempic and Wegovy that have become household names for diabetes and obesity management. Its strength lies in brand leadership, global distribution networks, and continuous pipeline innovation, including high-dose oral semaglutide.

Eli Lilly has emerged as an equally strong force, fueled by the rapid success of Mounjaro (tirzepatide) for diabetes and Zepbound for obesity. Lilly’s aggressive expansion in long-acting injectables, oral GLP-1s such as orforglipron, and combination therapies has allowed it to capture nearly 60% of the U.S. obesity drug market.

Together, Novo and Lilly account for more than 75% of worldwide GLP-1 revenues, making the sector a classic duopoly with high barriers to entry.

Medium-Tier Players: Building Competitive Pipelines

Beyond the duopoly, several global pharmaceutical companies occupy a medium concentration tier. Their current revenues from GLP-1s are limited, but their pipeline bets and partnerships could shift market dynamics by 2027 and beyond.

-

Amgen is advancing MariTide (AMG 133), which has shown up to 20% weight loss in Phase 2 trials.

-

Roche strengthened its presence with the Carmot Therapeutics acquisition, inheriting a portfolio of GLP-1 and dual agonist candidates.

-

Boehringer Ingelheim and Zealand Pharma are co-developing survodutide (BI 456906), a GLP-1/glucagon dual agonist that has demonstrated promising Phase 2 results.

-

AstraZeneca and Eccogene are working on ECC5004, an oral GLP-1 candidate aimed at tapping into the convenience-driven segment.

-

Sanofi had earlier retreated from the market but could re-enter through acquisitions or collaborations.

-

Pfizer, after halting its oral GLP-1 candidate danuglipron due to safety concerns, has effectively stepped back from the space.

These companies hold only single-digit market shares today, but their clinical progress could increase competitive intensity over the next decade.

Low-Tier Innovators: Biotech and Academic Entrants

At the bottom layer of the market structure are biotech firms and academic institutions. They may not yet command commercial share, but their innovation pipelines are shaping the long-term ecosystem.

-

Viking Therapeutics is developing VK2735, which has shown meaningful mid-stage weight loss results, positioning it as a potential competitor by 2027+.

-

Structure Therapeutics introduced GSBR-1290 as an oral GLP-1, though safety concerns have slowed its momentum.

-

Hangzhou Sciwind Biosciences, Fudan University, and Eccogene represent the growing wave of Chinese innovation, focusing largely on oral GLP-1s and low-cost alternatives for Asia.

-

Zealand Pharma continues to play both innovator and collaborator roles, bridging partnerships with larger pharma companies.

Though their market share is negligible today, these innovators represent the future disruption layer of the ecosystem.

Peripheral Players: Watching and Supporting the Market

Some global pharma giants and medical device firms are not directly competing in GLP-1 development but are strategically positioned around the ecosystem. Merck & Co., AbbVie, Bayer AG, and Teva are monitoring opportunities through licensing, collaborations, or dual/triple agonist research.

Meanwhile, Medtronic and other device makers are indirectly benefiting as GLP-1 adoption reduces the burden on traditional diabetes devices like insulin pumps. This interplay highlights how GLP-1 growth impacts adjacent industries, not just pharmaceuticals.

Ecosystem Dynamics

The GLP-1 analogues ecosystem is shaped by multiple interlinked dynamics:

-

Pipeline Race for Oral Therapies – Oral GLP-1 formulations are emerging as the next frontier, as patients increasingly prefer needle-free options. Novo, Lilly, Roche, Amgen, and Viking are leading this race.

-

Combination Therapies – Dual and triple agonists (GLP-1/GIP, GLP-1/GCG, GLP-1/GIP/GCG) are being developed to deliver superior outcomes in weight reduction and metabolic health.

-

Manufacturing and Supply Scaling – Capacity is a critical challenge. Lilly is investing $27 billion in U.S. manufacturing expansions, while Novo is scaling globally to meet surging demand.

-

Access and Affordability – Despite success, GLP-1s remain costly, raising concerns over equitable access. Insurers are expanding coverage, but affordability will remain a defining issue.

-

Digital Health and Distribution – Telehealth, e-pharmacies, and subscription models are transforming access, particularly in the U.S., India, and China, creating new channels for patient engagement.

Market Structure Outlook

By 2030, the GLP-1 market will remain highly concentrated, but new entrants are likely to reduce duopoly dominance slightly. Amgen, Roche, and Viking could capture share once their candidates reach commercialization, while Chinese innovators may play a significant role in cost-sensitive markets.

The Herfindahl–Hirschman Index (HHI) confirms a high-concentration structure today, reflecting Novo and Lilly’s control. Barriers to entry remain steep, given the enormous R&D investments, lengthy clinical trial requirements, and manufacturing complexities involved.

In the near term, concentration will remain tight. Over the long term, the ecosystem will broaden, with greater involvement from second-tier pharma, biotechs, digital health platforms, and adjacent device manufacturers.

Recent Developments

- In August 2025, Viking Therapeutic announced encouraging mid-stage trial results for its experimental oral/injectable weight loss drug VK2735, which achieved up to 12.2% body weight reduction over 12 weeks, through shares dropped due to higher treatment discontinuation from gastrointestinal side effects.

(Source: https://www.reuters.com) - In July 2025, Dr. Reddy’s Laboratories announced plans to launch a generic version of Novo Nordisk’s weight loss drug Wegovy in 87 countries beginning next year, contingent on patent expirations initially targeting markets like India, with expansion to the U.S. and Europe between 2029-2033.

(Source: https://www.reuters.com)

Segments Covered in the Report

By Product Type

- Injectable GLP-1 Analogues

- Oral GLP-1 Analogues

By Application

- Type 2 Diabetes Mellitus

- Obesity Management

- Cardiovascular Diseases

By Route of Administration

- Subcutaneous Injection

- Oral Administration

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- GLP-1 Analogues Market Set to Surpass USD 879.9 Billion by 2034, Driven by Rising Diabetes and Obesity Rates - September 2, 2025

- Gift Cards Market Size to Achieve USD 3.81 Trillion by 2034, Driven by Digital Payments and E-Commerce Growth - September 1, 2025

- Surgical Snare Market: How AI and Minimally Invasive Surgery Are Shaping the Future - September 1, 2025