Lyophilized Injectable Drug Market Set to Exceed USD 1.33 Trillion by 2034 as Biologics and Oncology Therapies Drive Global Surge

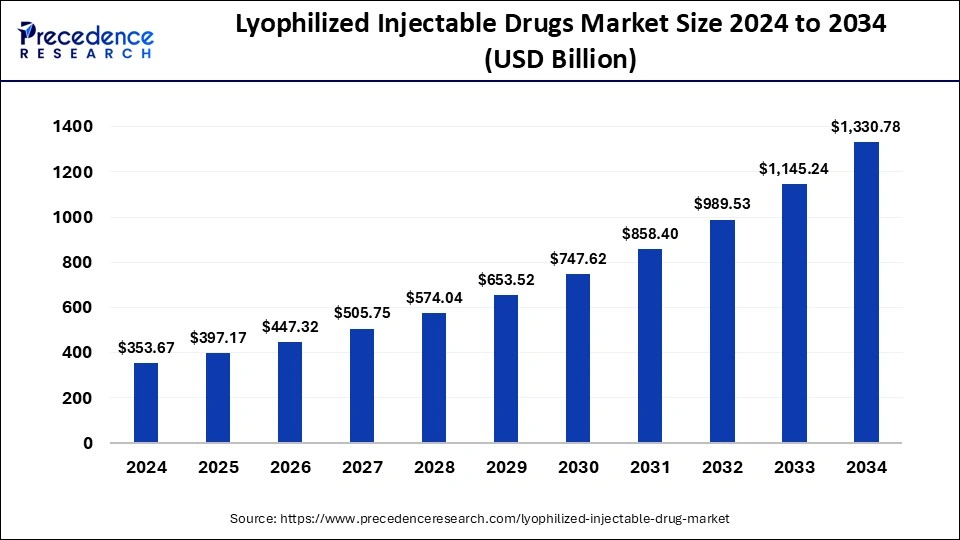

The global lyophilized injectable drug market is poised for extraordinary growth, with market size expected to surpass USD 1,330.78 billion by 2034, rising from USD 397.17 billion in 2025. According to a new report by Precedence Research, the industry will expand at a compound annual growth rate (CAGR) of 14.40% between 2025 and 2034, driven by the increasing burden of chronic diseases, innovation in drug packaging technologies, and the expansion of biopharmaceutical research and development.

In 2024, the market was valued at USD 353.67 billion, with North America commanding the largest share, while Asia Pacific is expected to witness the fastest growth throughout the forecast period. Growing investments from pharmaceutical and biotech industries are fueling R&D activities, ultimately strengthening the adoption of lyophilized injectable formats that ensure longer shelf life, stability, and transportability.

“The convergence of biologic innovation and chronic care demand is transforming the lyophilized injectable landscape,” said Rohan Patil, Principal Consultant at Precedence Research. “As healthcare systems push for stability, safety, and speed, lyophilized solutions are emerging as indispensable tools in both hospital and home-care settings.”

Market Size Projections

-

2024: USD 353.67 Billion

-

2025: USD 397.17 Billion

-

2030: USD 747.62 Billion

-

2032: USD 989.53 Billion

-

2034: USD 1,330.78 Billion

📥 Download Sample Pages for Informed Decision-Making 👇 https://www.precedenceresearch.com/sample/4180

Lyophilized Injectable Drug Market Drivers and Growth Outlook

The surge in lyophilized injectables is largely attributed to their superior performance in maintaining drug stability and preventing spoilage. For example, several U.S. hospitals reported a 30% reduction in drug wastage and improved emergency response times after shifting to lyophilized formats, underscoring their vital role in critical care environments.

Biologics, peptides, and monoclonal antibodies—highly sensitive to moisture and temperature—are driving the adoption of lyophilization. At the same time, the rapid rise of personalized and precision medicine is creating demand for custom formulations and stable storage solutions. Advances in technology, including continuous lyophilization, real-time monitoring systems, and automated fill-finish processes, are improving efficiency and reducing production costs by as much as 25% while ensuring compliance with GMP standards.

Market Challenges

Despite strong growth prospects, the industry faces significant hurdles. Lyophilization remains a capital-intensive process, requiring expensive equipment and advanced technology. This complexity often deters small and mid-sized manufacturers from entering the market. Additionally, reliance on robust cold chain infrastructure adds logistical costs and operational challenges. Nevertheless, expanding opportunities in oncology, autoimmune therapies, and biologics are expected to outweigh these barriers.

Lyophilized Injectable Drug Market Revenue Analysis by Key Segments:

Lyophilized Injectable Drugs Market Revenue (USD Million) By Drug Type 2022-2024

| Drug Type | 2022 | 2023 | 2024 |

| Anti-infective | 88,674.4 | 99,448.6 | 1,11,676.4 |

| Anti-neoplastic | 1,07,403.3 | 1,20,816.4 | 1,36,079.9 |

| Anticoagulant | 10,188.5 | 11,360.2 | 12,682.7 |

| Hormones | 6,636.9 | 7,386.6 | 8,231.1 |

| Antiarrhythmic | 21,445.2 | 24,139.3 | 27,206.8 |

| Others | 46,283.8 | 51,687.1 | 57,794.8 |

Lyophilized Injectable Drugs Market Revenue (USD Million) By Packaging 2022-2024

| Packaging | 2022 | 2023 | 2024 |

| Vials | 1,76,668.7 | 1,97,880.3 | 2,21,925.7 |

| Cartridges | 25,657.6 | 28,836.6 | 32,451.3 |

| Prefilled Devices | 78,305.7 | 88,121.2 | 99,294.7 |

🧠 Make Informed Decisions | 📊 Access Detailed Insights Here 👉 https://www.precedenceresearch.com/checkout/4180

How Big is the U.S. Lyophilized Injectable Drug Market?

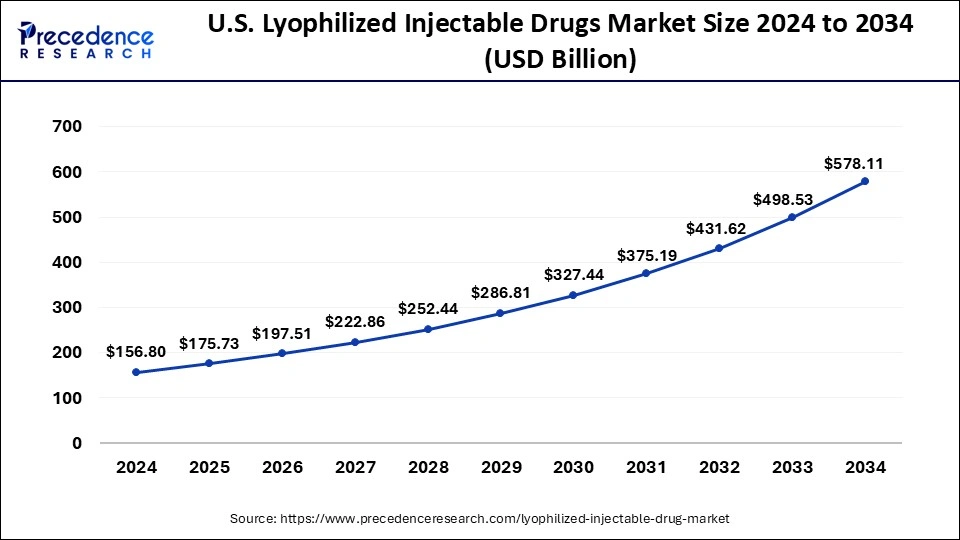

According to Precedence Research, the U.S. lyophilized injectable drug market is valued at USD 175.73 billion in 2025 and is projected to reach nearly USD 578.11 billion by 2034, registering a healthy CAGR of 14.10% during the forecast period (2025–2034).

📥 The complete study is now available for immediate access. Download sample pages here: Get Sample Report

Strong Pharmaceutical Backbone Propels North America’s Market Leadership

North America dominated the global lyophilized injectable drug market in 2024, supported by its advanced healthcare infrastructure and a well-established pharmaceutical industry. The region continues to benefit from its ability to deliver high-quality medicines, including long-lasting and modern drug formulations, to a wide consumer base.

Moreover, the increasing prevalence of chronic diseases—driven by lifestyle shifts, fast-paced living, and dietary changes—has created a robust demand for stable, shelf-ready medications. This trend is expected to further strengthen North America’s market leadership in the years ahead.

📌 Also Read: The Untapped Potential of Drug Repurposing in Precision Medicine

Strong Pharmaceutical Backbone Propels North America’s Market Leadership

North America dominated the global lyophilized injectable drug market in 2024, supported by its advanced healthcare infrastructure and a well-established pharmaceutical industry. The region continues to benefit from its ability to deliver high-quality medicines, including long-lasting and modern drug formulations, to a wide consumer base.

Moreover, the increasing prevalence of chronic diseases—driven by lifestyle shifts, fast-paced living, and dietary changes—has created a robust demand for stable, shelf-ready medications. This trend is expected to further strengthen North America’s market leadership in the years ahead.

📌 Also Read: The Untapped Potential of Drug Repurposing in Precision Medicine

Could Healthcare Investments in Europe Spark a Regional Manufacturing Boom?

Europe is also positioned for notable expansion, backed by large-scale pharmaceutical production facilities and rising investment in healthcare infrastructure. These developments are expected to create attractive opportunities for local manufacturing and enhance the region’s capacity to produce reliable, shelf-stable drugs. As patient demand for accessible and safe injectable therapies grows, Europe’s market potential is set to accelerate significantly during the forecast period.

📌 Also Read: Why Cloud Technology is Critical for Next-Gen Healthcare Delivery

Strategic Outlook for Stakeholders

For investors and healthcare manufacturers, the spotlight is shifting toward Asia-Pacific, the fastest-growing region in this market. Companies that establish localized manufacturing facilities early will likely enjoy regulatory advantages, long-term competitive positioning, and greater access to emerging consumer bases. The combination of rapid healthcare upgrades and increasing demand for biologics and oncology treatments makes Asia-Pacific the next major growth hub in the global lyophilized injectable drug industry.

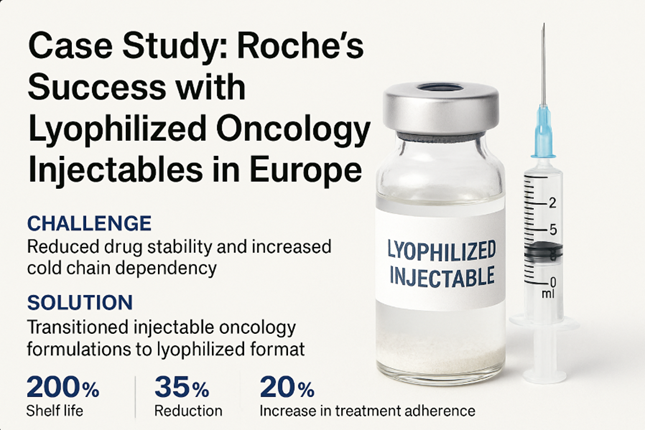

📚 Case Study: Roche’s Success with Lyophilized Oncology Injectables in Europe

Roche, a leading global pharmaceutical company, has heavily invested in lyophilized drug technology to meet the growing demand for stable, long-shelf-life medications in oncology. The company’s European production facility in Germany was upgraded in 2022 to include advanced lyophilization chambers, targeting next-generation anti-neoplastic drugs.

Challenge

Roche needed to ensure drug stability and reduce cold chain dependency for its targeted cancer therapies. Many of its monoclonal antibody-based drugs were prone to degradation under variable temperature and moisture conditions during transport.

Solution

Roche transitioned several of its injectable oncology formulations from liquid to lyophilized format. The company employed advanced automated fill-finish systems and continuous lyophilization technology to enable large-scale production while maintaining high bioavailability.

Results

- Shelf Life Improved by 200% for key oncology products (up to 36 months).

- Logistics Costs Reduced by 35% due to reduced cold chain dependencies.

- Adoption by 60+ European Hospitals within 18 months.

- Roche also reported a 20% increase in treatment adherence as physicians favored the new format due to its stability and convenience in hospital settings.

Strategic Takeaway

This success positioned Roche as a market leader in the lyophilized anti-neoplastic segment across Europe. The company’s early move into local production, coupled with innovations in lyophilization technology, granted it a competitive edge, especially as regulatory bodies across the EU encouraged robust, shelf-stable medication formats post-pandemic.

Ready to Capitalize on the $1.33 Trillion Opportunity?

Unlock competitive insights, strategic forecasts, and investment opportunities in the Lyophilized Injectable Drug Market.

👉 Download the Full Market Report Now:

https://www.precedenceresearch.com/checkout/4180

💬 Need Custom Data or Regional Analysis?

Schedule a call with our analysts for tailored insights that match your business goals.

📅 Book a Strategy Session Here:

https://www.precedenceresearch.com/schedule-meeting

Lyophilized Injectable Drug Market Segmentation Analysis

By Drug Type Analysis

Why Did the Anti-Infective Segment Lead the Lyophilized Injectable Drug Market in 2024?

The anti-infective segment accounted for the largest share of the lyophilized injectable drug market in 2024, as these drugs are widely prescribed to treat bacterial and viral infections. Hospitals and emergency care facilities rely heavily on anti-infectives, and lyophilization significantly enhances their shelf life, ensuring availability during urgent medical needs. This ability to preserve drug stability has made lyophilized anti-infectives the backbone of hospital pharmacies and emergency response systems.

The anti-neoplastic segment is projected to grow at a remarkable pace during the forecast period. Rising global cancer cases have increased the demand for stable oncology treatments, and physicians are increasingly favoring lyophilized anti-neoplastic formulations for their long shelf life, easy storage, and reliable effectiveness. As cancer therapies continue to advance, lyophilized oncology injectables are expected to gain substantial market share.By Indication Analysis

How Does the Oncology Segment Maintain Market Dominance?

The oncology segment remained the largest contributor to the lyophilized injectable drug market in 2024. Lyophilization plays a crucial role in maintaining the stability and therapeutic effectiveness of cancer medications by protecting them from moisture and temperature variations. The method has gained widespread adoption in oncology, making lyophilized drugs indispensable for cancer care.

Meanwhile, the gastrointestinal disorders segment is anticipated to register significant growth during the forecast period. Changing lifestyles and dietary habits are driving higher incidences of gastrointestinal conditions, and lyophilized injectables have proven highly effective for these treatments. Their enhanced stability ensures consistent efficacy, making them increasingly preferred in clinical practice.

By Delivery Type Analysis

Why Did Pre-Filled Diluent Syringes Dominate the Market in 2024?

In 2024, pre-filled diluent syringes led the lyophilized injectable drug market due to their convenience and safety. These syringes contain a liquid diluent that mixes with the dry drug prior to injection, simplifying drug preparation and minimizing errors. Hospitals favor them as they save time, reduce contamination risks, and ensure greater accuracy in dosage administration.

The multi-step devices segment is projected to experience robust growth as patient self-administration becomes more common. Multi-step devices reduce preparation time, prevent contamination, and improve dosing accuracy, making them ideal for outpatient settings and home care. With the rise of chronic conditions requiring regular injections, demand for user-friendly, all-in-one delivery solutions is accelerating.

By Packaging Analysis

How Did Cartridges Secure the Largest Market Share?

The cartridges segment dominated the lyophilized injectable drug market in 2024. Cartridges are compact, safe, and easy to handle, making them widely used in hospitals and clinics. They fit seamlessly into pen injectors or syringes, enable precise dosing, reduce waste, and improve storage efficiency. For healthcare providers, these features translate into reliability and speed during critical treatments.

Looking forward, prefilled devices are expected to witness strong growth. These devices allow patients to self-administer medication at home, reducing hospital visits while improving convenience and safety. As the prevalence of chronic diseases rises and home-based care becomes more common, prefilled devices are emerging as the preferred solution for patients and providers alike.

By Distribution Channel Analysis

Why Did Hospital Pharmacies Dominate the Market in 2024?

In 2024, hospital pharmacies accounted for the largest share of the lyophilized injectable drug market. Hospitals handle significant volumes of injectables daily, particularly for life-threatening conditions such as cancer and severe infections. The long shelf life and stability of lyophilized drugs make them essential in surgeries, intensive care units, and emergency departments where immediate access and accurate dosing are critical.

The online pharmacy segment, however, is expected to grow at the fastest pace over the coming years. Increasing adoption of telemedicine and e-health platforms is driving patients to purchase injectables online for managing chronic conditions at home. The convenience of doorstep delivery, cost-effectiveness, and growing trust in digital healthcare platforms are making online pharmacies a vital growth channel for lyophilized injectable drugs.

Lyophilized Injectable Drugs Market Concentration

Who’s in the lead (brand/innovator layer)

-

The listed firms—Pfizer, Novartis, Roche, J&J, Sanofi, Amgen, AbbVie, Merck, Lilly, AstraZeneca, BMS, GSK, Gilead, Biogen, Teva, Mylan (Viatris), Celgene (BMS), Novo Nordisk, Vertex, Takeda—collectively anchor the innovator and specialty end of lyophilized injectables (oncology, immunology, anti-infectives, endocrine).

-

At the originator biologics & specialty injectables level, the market skews toward a moderate–to–high concentration because clinical, regulatory, and commercial moats (IP, antibodies, complex peptides, cold-chain know-how) keep smaller players out of first-line indications.

Where fragmentation rises

-

Generics/biosimilars (e.g., Teva, Viatris) and hospital-tender products are more fragmented than originator brands.

-

Geography matters: ex-US hospital and tender markets see more share dispersion due to local manufacturers and aggressive procurement.

Practical takeaway

-

Expect a “barbell” structure:

-

Top 10 innovators concentrate value in oncology, autoimmune, and high-margin hospital drugs.

-

A long tail of regional and generic players competes on cost in anti-infectives and supportive care.

-

Competitive Dynamics (Porter Snapshot)

-

Barriers to entry: High. Sterile/aseptic capacity, freeze-dry cycle development, validation, and GMP compliance require heavy capex and scarce know-how.

-

Supplier power: Medium→High. Critical inputs (Type I vials, stoppers, specialized excipients, single-use systems, isolators, freeze-dryers) have limited qualified vendors.

-

Buyer power: Medium. Hospital systems and tenders negotiate hard on commoditized lines; payers and HTA bodies pressure price, but innovators retain leverage via differentiation and outcomes.

-

Threat of substitutes: Low→Medium. Ready-to-use liquids and long-acting depots compete in some indications, but lyophilization remains essential for unstable APIs/biologics.

-

Rivalry: Medium. Innovators compete on efficacy/safety and delivery convenience; in generics, rivalry is price-led with supply reliability a key differentiator.

Ecosystem & Value Chain Map

Upstream (materials & equipment)

-

Primary packaging & components: Schott, Gerresheimer, Stevanato, SGD Pharma (vials/cartridges); West, Datwyler, Aptar (stoppers/seals); BD, Terumo (syringes/cartridges).

-

Process & equipment: GEA, SP Scientific (Harpscott), Telstar, Tofflon, IMA, OPTIMA (freeze-dryers, isolators, fill-finish, PAT sensors).

-

Excipients & formulation aids: BASF, DFE Pharma, Roquette, Avantor (bulking agents, stabilizers, cryo/lyo protectants).

-

Single-use & sterile utilities: Sartorius, Pall, Cytiva.

Midstream (development & manufacturing)

-

Innovators (your list): Own pipeline, IP, clinical, and commercial capabilities. Choose internal vs external fill-finish + lyophilization based on load and flexibility.

-

CDMOs (not exhaustive): Catalent, Lonza, Recipharm, Baxter BioPharma Solutions, PCI Pharma, Sharp, Samsung Biologics. They supply process development, cycle design, scale-up, and multi-site redundancy.

Downstream (distribution & access)

-

Cold-chain & logistics: DHL, UPS Healthcare, Kuehne+Nagel, Marken (controlled room temp and frozen chains).

-

Channels: Hospital pharmacies (dominant for oncology/critical care), retail/IDNs for chronic specialty, and e-pharmacies for home self-administration.

-

Payers/HTA: CMS/Medicare, PBMs, EU HTAs; drive pharmacoeconomic evidence and tender dynamics.

Operating Models You’ll See

-

Integrated innovator: Large pharma keeps high-value lyophilization in-house for control and IP protection; uses CDMOs for surge capacity.

-

Hybrid (most common): Internal clinical/tech transfer + external commercial scale for flexibility and speed-to-market.

-

Asset-light specialty: Smaller firms outsource end-to-end (formulation → cycle development → commercial lyo).

What Drives Share Gains

-

Cycle excellence & CQA control: Faster, robust lyophilization cycles (controlled nucleation, PAT, real-time sensors) → fewer deviations, higher uptime.

-

Device convenience: Cartridges, dual-chamber syringes, and on-body/pen systems reduce prep time and errors—key to hospital adoption and at-home growth.

-

Reliability & redundancy: Dual sourcing of components and multi-site lyo capacity wins tenders and de-risks launches.

-

Therapeutic focus: Oncology, autoimmune, endocrine (e.g., peptides/biologics) concentrate value; anti-infectives remain volume-heavy but price-sensitive.

Risks & Bottlenecks

-

Capacity pinch points: Freeze-dryer lead times, isolator qualification, and sterility assurance can bottleneck launches.

-

Component constraints: Pharmaceutical glass, stoppers, and syringe supply shocks ripple through fill-finish schedules.

-

Tech transfer complexity: Small formulation differences change sublimation dynamics; failed scale-ups cause write-offs and delays.

-

Quality/Regulatory: Annex 1, data integrity, media fills—any miss hits supply continuity and tender performance.

Strategic Moves for Stakeholders

-

Innovators (your listed companies):

-

Invest in continuous lyophilization/controlled nucleation and dual-chamber devices for speed and safety.

-

Build regionalized lyo nodes (US/EU/APAC) to win tenders and reduce logistics risk.

-

Strengthen CDMO frameworks with tech-transfer playbooks and shared PAT dashboards.

-

-

Generics/Biosimilars:

-

Differentiate on supply reliability and ready-to-reconstitute convenience in hospital settings; target shortages with agile lyo lines.

-

-

Suppliers & CDMOs:

-

Offer end-to-end cycle development + digital twins; guarantee slotting and validation timelines; co-invest in line upgrades tied to multi-year volume commitments.

-

What This Means for Market Concentration (Plain English)

-

The value pool is concentrated among the top 10–15 innovators (your list) in high-complexity indications.

-

Volume is more spread out across generics, hospital tenders, and regional producers.

-

Over the next 3–5 years, expect steady consolidation at the CDMO and packaging layers, while innovators retain share via pipeline strength, device ecosystems, and manufacturing resilience.

Lyophilized Injectable Drugs Market Companies

- Pfizer Inc.

- Novartis AG

- Roche Holding AG

- Johnson & Johnson

- Sanofi S.A.

- Amgen Inc.

- AbbVie Inc.

- Merck & Co., Inc.

- Eli Lilly and Company

- AstraZeneca PLC

- Bristol Myers Squibb Company

- GlaxoSmithKline plc

- Gilead Sciences, Inc.

- Biogen Inc.

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Celgene Corporation

- Novo Nordisk A/S

- Vertex Pharmaceuticals Incorporated

- Takeda Pharmaceutical Company Limited

Recent Developments

- In January 2023, the FDA signed its approval for the first lyophilized injectable drug that can be administered in the treatment of atopic dermatitis in children who are six months and older.

- In February 2023, a new technology for continuous lyophilization was strategized and developed aimed at improving the efficiency and quality of the process.

- In March 2023, a pharmaceutical company reported that it was expanding its manufacturing capacity for lyophilized injectable drugs so that the market could meet the growing demand.

Segments Covered in the Report

By Drug Type

- Anti-infective

- Anti-neoplastic

- Diuretics

- Proton Pump Inhibitor

- Anesthetic

- Anticoagulant

- NSAID’s

- Corticosteroids

- Others

By Indication

- Oncology

- Autoimmune Diseases

- Hormonal Disorders

- Respiratory Diseases

- Gastrointestinal Disorders

- Dermatological Disorders

- Ophthalmic Diseases

- Others

By Delivery Type

- Prefilled Diluent Syringes

- Multi-step Devices

By Packaging

- Vials

- Cartridges

- Prefilled Devices

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- India Eyes Rare Earth Partnership With Myanmar to Reduce Reliance on China - September 10, 2025

- Apple iPhone 17 Pro Max vs iPhone 17 Pro vs Samsung Galaxy S25 Ultra: Ultimate 2025 Flagship Comparison - September 10, 2025

- Israel and India Sign Investment Deal Amid Gaza War Controversy - September 9, 2025