Gift Cards Market Size to Achieve USD 3.81 Trillion by 2034, Driven by Digital Payments and E-Commerce Growth

Global Market Outlook

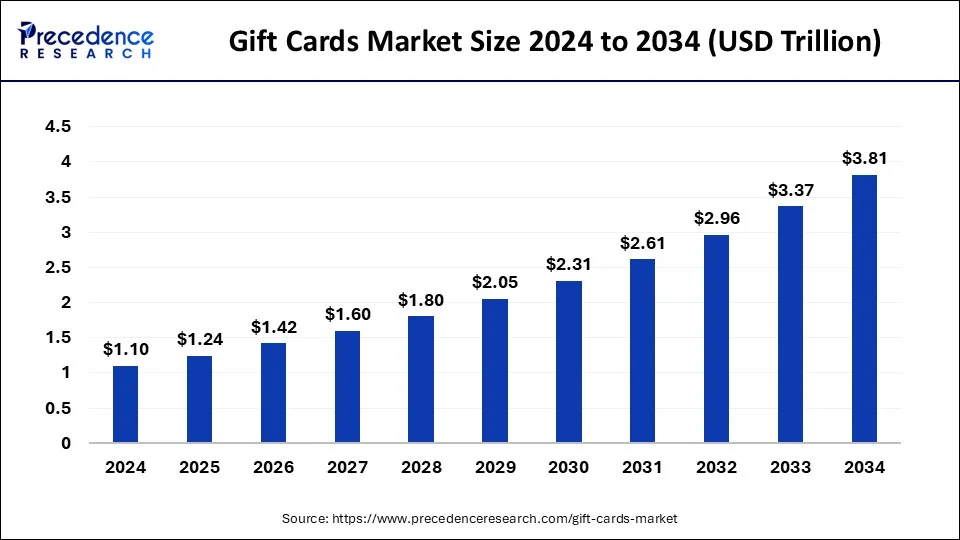

The global gift cards market size was valued at USD 1.10 trillion in 2024 and is projected to reach USD 3.81 trillion by 2034, growing at a CAGR of 13.24% from 2025 to 2034, according to the latest industry forecast. The market expansion is driven by the surge in digital payments, e-commerce penetration, and corporate gifting trends, which are reshaping consumer and business spending patterns.

Gift Cards Market Key Takeaways

- The global gift cards Market market was valued at USD 1.10 trillion in 2024.

- It is projected to reach USD 3.81 trillion by 2034.

- The market is expected to grow at a CAGR of 13.24% from 2025 to 2034.

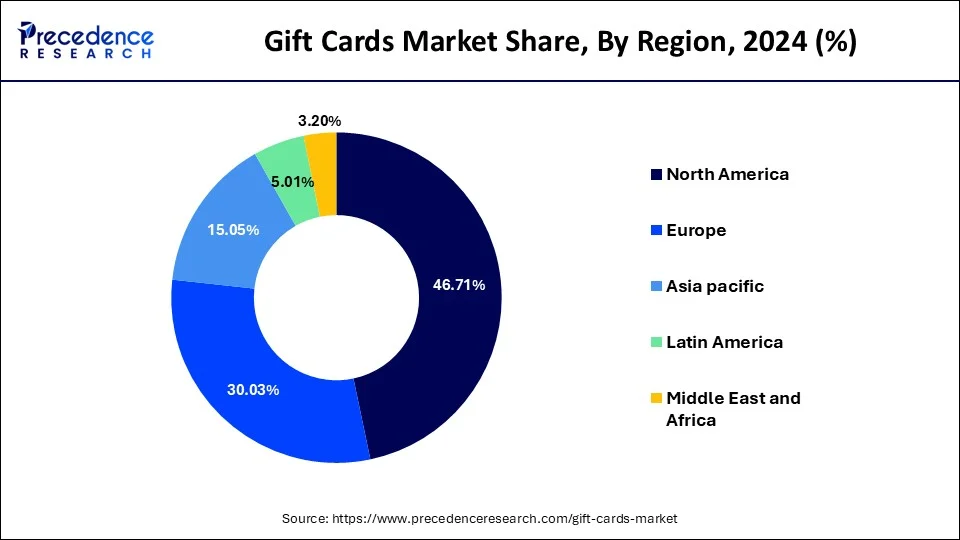

- North America dominated the global market with the largest market share of 46.71% in 2024.

- By type, the closed-loop gift cards segment contributed the highest market share of 39.54% in 2024.

- By type, the e-gift cards segment is expected to grow at a solid CAGR of 16.23% during the forecast period.

- By application, the closed-loop gift cards segment captured the biggest market share of 27.88% in 2024.

- By application, the e-gift cards segment is projected to grow at a solid CAGR of 15.42% during the forecast period.

- By type of consumer, the individuals (B2C) segment generated a major market share of 59.10% in 2024.

- By type of consumer, the businesses/corporate (B2B) segment is expected to expand at a solid CAGR of 14.61% during the forecast period.

- By distribution channel, the online sales segment has held the largest market share of 61.35% in 2024.

- By distribution channel, the offline sales segment is expected to expand at a solid CAGR of 9.18% during the forecast period.

Key Insights

-

Market Size 2024: USD 1.57 Trillion

-

Forecast 2034: USD 3.81 Trillion

-

CAGR (2025–2034): 9.2%

-

Largest Market: North America

-

Fastest Growing Market: Asia Pacific

-

Leading Segment: E-Gift Cards

Market Drivers

-

Rapid growth of e-commerce platforms offering integrated gift card options.

-

Widespread adoption of contactless and digital payment solutions.

-

Rising popularity of corporate gift cards for employee recognition and loyalty programs.

-

Demand for personalized and brand-specific gifting solutions.

Market Challenges

-

Fraud risks and cyber security threats associated with digital gift cards.

-

Limited consumer awareness in emerging markets.

Opportunities Ahead

-

Expansion of AI and blockchain in securing transactions and enhancing personalization.

-

Rising demand for cross-border e-gifting solutions.

-

Integration of BNPL (Buy Now, Pay Later) models with gift card programs.

Browse Detailed Insights@ https://www.precedenceresearch.com/gift-cards-market

Scope of Gift Cards Market

| Report Coverage | Details |

| Market Size in 2025 | USD 1.24 Trillion |

| Market Size by 2034 | USD 3.81 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.24% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Consumer Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expert Insight

“Digitalization is redefining the gifting economy. With e-commerce growth and secure payment innovations, gift cards are evolving from traditional vouchers to personalized digital assets, making them a powerful tool for both consumers and businesses,” said a lead analyst at Precedence Research.

Case Study: Houston Police Union vs. Kroger – The Hidden Dangers of Physical Gift Card Fraud

Gift cards are often considered convenient, trusted, and secure by both consumers and corporations. However, a recent case in the United States demonstrates how vulnerabilities in distribution and activation systems can undermine this trust.

The Incident:

In August 2023, the Houston Police Officers’ Union purchased four $100 Visa gift cards from a Kroger supermarket in Texas. The cards were intended as rewards for union members. When the cards were later redeemed, they were discovered to have only $2 remaining on each, suggesting that criminals had drained the balance before the cards were ever sold.

The union has since filed a lawsuit against Kroger, claiming the retailer failed to implement adequate security measures despite being aware of widespread fraud schemes targeting in-store gift cards. These scams often involve thieves tampering with cards on racks, recording their numbers, and then waiting until after activation to drain the funds.

Key Insights:

- Retailer liability: The lawsuit underscores how retailers can be held accountable if they fail to safeguard gift cards.

- Consumer trust risk: Even organizations like a police union fell victim, highlighting how fraud erodes public confidence in physical cards.

- Security measures needed: Experts suggest retailers move cards behind counters, use tamper-proof packaging, and enhance real-time monitoring of activations.

Industry Impact:

This case is a powerful reminder that while digital gift cards are gaining dominance, physical cards remain highly susceptible to fraud if retailers do not invest in security. For the global market, it raises the stakes around regulatory standards and fraud prevention technologies.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Latest Trends Shaping the Gift Cards Market

1. Digital-First Revolution: Virtual Gift Cards Take the Lead: Digital and e-gift cards have become the new standard, representing nearly half of the overall market. Their instant delivery, eco-friendliness, and convenience are driving widespread consumer adoption.

2. Mobile Wallet Integration Enhances Convenience: Consumers are increasingly storing and redeeming gift cards through mobile wallets such as Apple Pay and Google Wallet, ensuring both seamless usability and enhanced security.

3. Hyper-Personalization Powered by AI: Artificial intelligence is transforming gift cards into personalized experiences. From tailored card designs and messages to AI-driven suggestions based on recipient preferences, personalization is redefining customer engagement.

4. Corporate Gifting and Loyalty Programs Gain Momentum: Employers and brands are embedding gift cards into employee rewards, incentive schemes, and loyalty programs. This not only strengthens engagement but also boosts long-term retention.

5. Rising Trend of Self-Use for Budget Control: Gift cards are no longer just for gifting—consumers are increasingly purchasing them for personal use, leveraging them as tools to manage budgets, track spending, and control expenses.

6. Sustainability Drives Eco-Friendly Choices: The demand for eco-conscious gifting is pushing brands toward fully digital cards and sustainable physical options, such as biodegradable gift cards, aligning with global sustainability goals.

7. Omnichannel Redemption Becomes the Norm: Today’s consumers expect unified redemption experiences, whether shopping online, through mobile apps, or at physical stores. The omnichannel shift is becoming essential for brand competitiveness.

Gift Cards Market Regional Analysis

How Big is the U.S. Gift Cards Market?

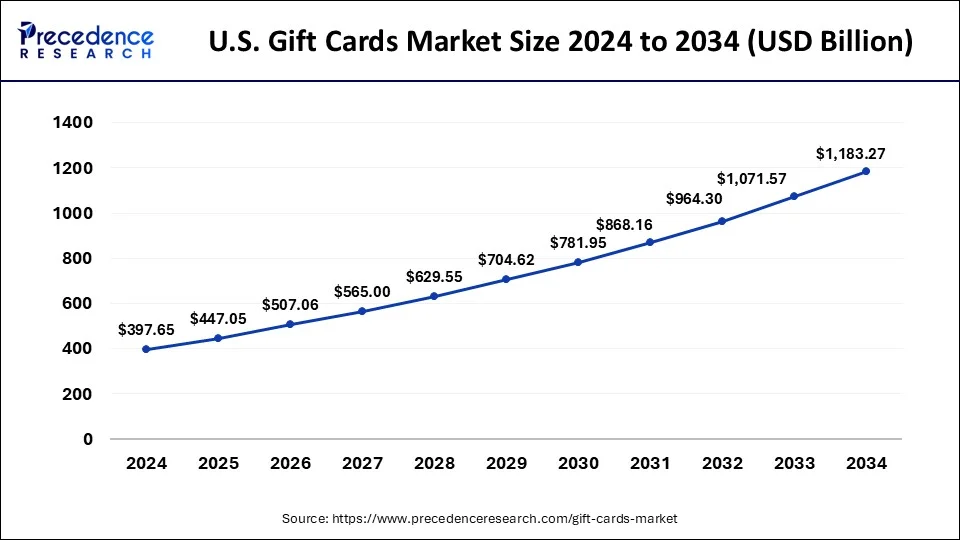

The U.S. gift cards market was valued at USD 447.05 billion in 2025 and is projected to expand from USD 507.06 billion in 2026 to nearly USD 1,183.27 billion by 2034. This represents a robust CAGR of 11.42% between 2025 and 2034. Growth is fueled by the rising adoption of digital payments, e-commerce shopping, and mobile wallet integration, making gift cards an increasingly preferred choice for both consumers and corporations.

Why Does North America Dominate the Global Gift Cards Market?

North America held the largest market share in 2024, underpinned by its consumer-driven culture and the widespread use of gift cards to celebrate milestones such as weddings, graduations, birthdays, and holiday events. Retailers and corporations in the region are actively promoting gift card adoption through loyalty programs, seasonal campaigns, and promotional incentives.

The U.S. is a key growth driver within North America, supported by:

-

The surge in digital gift cards linked to mobile payments and online shopping.

-

Increasing use of apps and integrated platforms that connect gift cards with e-wallets and e-commerce ecosystems.

-

Strong consumer preference for convenience and personalization in gifting.

Together, these factors position North America as a mature but steadily expanding market, with the U.S. playing a central role in shaping its trajectory.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/4230

Why is Asia Pacific the Fastest-Growing Market for Gift Cards?

Asia Pacific is projected to register the fastest growth rate during the forecast period, driven by rapid digitalization and evolving consumer behavior. Gift cards are increasingly popular among consumers in this region due to their flexibility, customization, and convenience, allowing recipients to select products and services tailored to their preferences.

Key growth drivers include:

-

E-commerce expansion, with gift cards widely used in promotional campaigns across online retail platforms.

-

A cultural shift toward modern gifting practices, blending traditional celebrations with contemporary digital solutions.

-

Strong adoption of festive and seasonal gift cards, aligned with cultural events and festivals in countries such as India, China, and Japan.

As a result, Asia Pacific is emerging as the fastest-growing hub of the global gift cards market, with a strong outlook for both digital and physical formats.

Gift Cards Market Segmentation Analysis

Why Do Closed-Loop Gift Cards Dominate the Market?

Closed-loop gift cards led the market in 2024, thanks to their extensive adoption by retailers and corporate institutions. These cards are widely used in holiday promotions, loyalty programs, and customer reward campaigns, making them a powerful tool to influence consumer spending within retail ecosystems.

They often include exclusive perks such as bonus credits, discounts, or bundled rewards, which encourage repeat purchases and enhance brand loyalty. By driving both engagement and revenue, closed-loop gift cards remain the preferred choice for businesses.

Why Are E-Gift Cards Growing the Fastest?

E-gift cards are forecasted to grow at the fastest pace during the coming years. Their success is tied to instant delivery, eco-friendliness, and convenience, offering a perfect solution for last-minute gifting.

They also align with sustainability goals by eliminating the need for plastic, packaging, and shipping. With their speed, flexibility, and personalization options, e-gift cards are becoming the preferred gifting method across global markets.

Why Is Consumer Gifting the Largest Application Segment?

Consumer gifting accounted for the largest market share in 2024. Gift cards are valued for their convenience, personalization, and ability to strengthen relationships. They allow recipients to choose what they want, making them one of the most versatile gifting options.

For retailers, consumer gifting serves as a strategic engagement tool, helping to build loyalty and maintain connections with customers before, during, and after key festive seasons.

Why Is Healthcare & Wellness the Fastest-Growing Application?

The healthcare and wellness segment is expected to grow rapidly during the forecast period. Rising awareness of healthy lifestyles and preventive healthcare is driving demand for wellness-related gift cards.

From gym memberships and spa experiences to nutrition planning and wellness products, these gift cards are popular among both individuals and corporations. Businesses also leverage wellness gift cards as part of employee recognition and well-being programs, further fueling segment growth.

Why Do Individuals (B2C) Dominate the Consumer Base?

The B2C segment dominated the market in 2024, supported by the popularity of gift cards for birthdays, weddings, and festive occasions. Consumers value the freedom and flexibility that gift cards provide, enabling recipients to select products or services that suit them best.

The expansion of e-commerce platforms and mobile wallets has boosted consumer demand even further, reinforcing B2C as the dominant segment.

Why Is the Businesses (B2B) Segment Growing So Quickly?

The B2B segment is projected to grow at the fastest rate, as organizations increasingly use gift cards for employee rewards, sales incentives, and client appreciation programs.

Companies benefit from higher employee engagement and stronger partnerships, while e-gift cards make distribution easy, trackable, and scalable. This trend positions B2B as one of the most dynamic segments in the industry.

Why Do Online Channels Lead in Distribution?

Online channels captured the largest share in 2024, reflecting the rise of e-commerce and digital payments. Online platforms enable consumers to buy, send, and redeem gift cards instantly via apps, emails, or web portals.

Their integration with cashless transactions and smartphone usage makes online channels the backbone of the modern gift card ecosystem.

Why Are Offline Channels Still Growing?

Despite digital dominance, offline channels are expected to grow quickly during the forecast period. Many consumers still enjoy the tangible, personal experience of buying physical gift cards in-store.

Supermarkets, department stores, and retail chains use gift cards as marketing and promotional tools, offering discounts, bundled deals, or free cards to drive sales. This ensures offline channels remain a valuable part of the overall market.

Gift Cards Market concentration — where power sits (qualitative)

-

Closed-loop issuers (retail, F&B, travel, digital content):

Fragmented. No single retailer dominates globally. Big brands (Amazon, Walmart, Starbucks, McDonald’s, Target, Marriott, Netflix, Spotify, Microsoft, Sony, Airbnb, H&M, Walgreens, Zalando) are powerful inside their own ecosystems but the overall issuer landscape remains diffuse. -

Open-loop networks (bank-branded/prepaid):

Concentrated/oligopolistic. (Among your list, American Express is the relevant open-loop brand.) Open-loop issuance and rails tend to concentrate in a few networks. -

Aggregators / program managers / distribution (B2B racks, APIs, corporate):

Highly concentrated. Blackhawk Network and InComm Payments control a large share of large-scale distribution (in-store racks, e-codes, APIs) and corporate programs across retailers and digital brands. -

Channels / redemption:

Mixed. Online/digital is increasingly concentrated in a few large marketplaces and app ecosystems (e-commerce, app stores, wallets), while physical retail distribution is more consolidated around top grocers, drugstores, and big-box chains. -

Margin pools:

Closed-loop issuers capture margin via breakage, upsell, and basket lift; aggregators monetize via distribution fees & program management; open-loop players monetize via interchange & fees.

Also Read@ Next-Generation RNA Therapeutics Market: Transforming Drug Discovery and Precision Medicine

Ecosystem map — who does what

Value chain:

Raw value (brand/store credit) → Issuer/Brand → (optional) Program Manager/Processor → Aggregator/Distributor (racks, APIs, corporate) → Sales Channels (retail POS, e-commerce, wallets, B2B portals) → End user → Redemption (issuer’s store/app/site) → Settlement & breakage accounting.

Enablers: fraud/risk, KYC/AML (open-loop), wallet integration, tax/escheatment, analytics/personalization, loyalty & CRM.

Company roles at a glance

|

Company |

Primary role(s) | Loop type | Core strengths / notes |

|---|---|---|---|

| Amazon.com, Inc. | Issuer; massive first-party & third-party marketplace acceptance | Closed-loop | Ubiquity online; strong B2C/B2B demand; high breakage/basket lift potential |

| Walmart | Issuer; major physical retail acceptance | Closed-loop | Shelf presence + e-gift; impulse rack sales; broad demographics |

| Starbucks Coffee Company | Issuer; stored-value powerhouse | Closed-loop | Industry-leading reload & loyalty integration; high repeat redemption |

| McDonald’s Corporation | Issuer (QSR) | Closed-loop | Frequency + promos; drive-thru/app redemption |

| Target Corporation | Issuer; channel for others (racks) | Closed-loop | Omni-channel; seasonal volume; strong private-label tie-ins |

| Netflix Inc. | Issuer (subscription content) | Closed-loop | Gift-to-subscription conversion; great for un/underbanked |

| Spotify AB | Issuer (subscription content) | Closed-loop | Prepaid subs; promo bundles; student/youth appeal |

| Microsoft | Issuer (Xbox/Store) | Closed-loop | Gaming & digital goods; global digital redemption |

| Sony Corporation | Issuer (PlayStation/Entertainment) | Closed-loop | Large gaming TAM; promotional bundles |

| Marriott International, Inc. | Issuer (hospitality) | Closed-loop | Gift-to-loyalty funnel; packages/upgrades |

| Airbnb, Inc. | Issuer (travel marketplace) | Closed-loop | Gifting for experiences; cross-border digital |

| Zalando | Issuer (fashion e-commerce) | Closed-loop | EU focus; returns/friction relief; loyalty |

| Walgreen Co. | Issuer; major physical rack channel | Closed-loop | Pharmacy footfall; last-minute purchases |

| H&M Group | Issuer (fashion retail) | Closed-loop | Youth-centric; fast-fashion seasonality |

| InComm Payments | Aggregator / program manager / processing / distribution | Multi | Racks, APIs, prepaid tech; corporate fulfillment |

| American Express Company | Open-loop network & issuer | Open-loop | Premium brand; corporate programs; interchange economics |

| Blackhawk Network | Aggregator / distribution / B2B & digital | Multi | Large retailer network; APIs; corporate & incentives |

| Other | Niche issuers, regional retailers, fintechs, wallets | Mixed | Fill category/geo gaps; innovation niches |

How the pieces interact (simplified)

-

Issuers (Amazon, Walmart, Starbucks, Netflix, Microsoft, Sony, Marriott, Airbnb, H&M, Zalando, Walgreens, Target, McDonald’s) create value, define terms, and redeem.

-

Aggregators (Blackhawk, InComm) connect issuers to channels (grocery, drug, big-box racks; e-commerce; APIs for app/loyalty platforms; corporate portals), handle sourcing, breakage/settlement reporting, and anti-fraud tooling.

-

Open-loop (American Express) issues network-branded cards used across multiple merchants; requires KYC/AML, manages fraud, and relies on network rails & interchange.

-

Channels include physical racks (Target, Walgreens, Walmart), branded websites/apps, corporate incentive portals, and mobile wallets.

-

Consumers & enterprises drive demand: B2C for gifting/self-use; B2B for rewards, promos, and customer acquisition.

Competitive dynamics & moats

-

Distribution power: Blackhawk & InComm have entrenched retailer relationships (end-cap space, racks) and digital/API integrations—high barriers for new entrants.

-

Ecosystem lock-in: Big issuers pair gift cards with loyalty (Starbucks, Marriott), subscriptions (Netflix, Spotify), or marketplaces (Amazon) to raise switching costs.

-

Digital shift: E-gift + wallet integration reduces cost, speeds delivery, and deepens data/analytics—advantage to issuers with strong apps and CRM.

-

Promotions & seasonality: Q4 drives outsized volume; retailers with strong seasonal marketing capture share.

-

Regulatory & accounting: Open-loop faces KYC/AML; all issuers manage escheatment/unclaimed property and breakage; expertise here is a moat.

What this means tactically

-

Issuers (retail/brands): Win with loyalty integration, targeted bonuses (bonus value tiers), and frictionless omni-redeem.

-

Aggregators: Maintain moat via exclusive retailer rack space, best-in-class fraud controls, and deep corporate (B2B) portals/APIs.

-

Open-loop (AmEx): Compete on acceptance + perks, corporate distribution, and premium brand positioning.

-

Channels: Feature seasonal end-caps, cross-promo bundles, and instant e-delivery; optimize for impulse purchase and last-minute gifting.

Gift Cards Market Companies

- Amazon.com, Inc.

- Walmart

- Starbucks Coffee Company

- McDonald’s Corporation

- Target Corporation

- Netflix Inc.

- Spotify AB

- Microsoft

- Sony Corporation

- Marriott International, Inc.

- Airbnb, Inc.

- Zalando

- Walgreen Co.

- H&M Group

- InComm Payments

- American Express Company

- Blackhawk Network

- Other

Industry Leader Announcement

- In March 2025, Razorpay introduced Engage Gift Cards at the 6th edition of its flagship event, Razorpay FTX’25. Engage Gift Cards is the India’s first intelligent, customisable gift card platform designed to redefine customer loyalty and engagement. Arpit Chug, CFO of Razorpay, said, “We envisioned a smarter way for businesses to engage their customers, beyond just discounts and ads. With Engage Gift Cards Platform, businesses are in complete control, allowing them to customize discounts for different customer and design gift cards for specific products or services.”

Recent Developments

- In October 2024 (Oct 24, 2024), Hallmark introduced its innovative “Gift Card Greetings”, merging traditional greeting cards with embedded QR‑coded digital gift cards. Priced at $4.99 and available via Hallmark’s Gold Crown stores and website, this hybrid solution combines tangible sentiment with the convenience of digital gifting, redeemable at over 100 major retailers.

(Source: https://www.theverge.com) - In February 2024, Roblox, a worldwide immersive platform for communication and engagement, and Blackhawk Network (BHN) have teamed up to provide digital gift cards in the following currencies: Austrian (EUR), Belgian (EUR), Swiss Franc (CFH), and Brazilian Real (BRL) on Roblox’s gift card website, Roblox.com/giftcards. Customers in each nation can now use local currencies to purchase Roblox digital gift cards.

- In July 2024, Air India launched Air India Gift Cards for both domestic and international flights. These cards provide a great way for travelers to gift traveling experiences to their loved ones. These cards are available from Rs 1,000 to Rs 200,000.

Segments Covered in the Report

By Type

- Closed-Loop Gift Cards

- Open-Loop Gift Cards

- E-Gift Cards

- Physical Gift Cards

- Promotional & Loyalty Gift Cards

- Others (Cryptocurrency Gift Cards, etc.)

By Application

- Consumer Gifting

- Corporate Gifting & Incentives

- Online Shopping & E-Commerce

- Travel & Hospitality

- Food & Beverages

- Entertainment & Media

- Healthcare & Wellness

- Others (Charity & Donation, etc.)

By Type of Consumer

- Individuals (B2C)

- Businesses/Corporate (B2B)

- Institutional/Non-Profit Organizations

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- GLP-1 Analogues Market Set to Surpass USD 879.9 Billion by 2034, Driven by Rising Diabetes and Obesity Rates - September 2, 2025

- Gift Cards Market Size to Achieve USD 3.81 Trillion by 2034, Driven by Digital Payments and E-Commerce Growth - September 1, 2025

- Surgical Snare Market: How AI and Minimally Invasive Surgery Are Shaping the Future - September 1, 2025