OTC Drugs Market on the Rise: How Self-Care and E-Commerce Are Shaping a $242.9 Billion Future

OTC Drugs Market Size 2025 to 2034

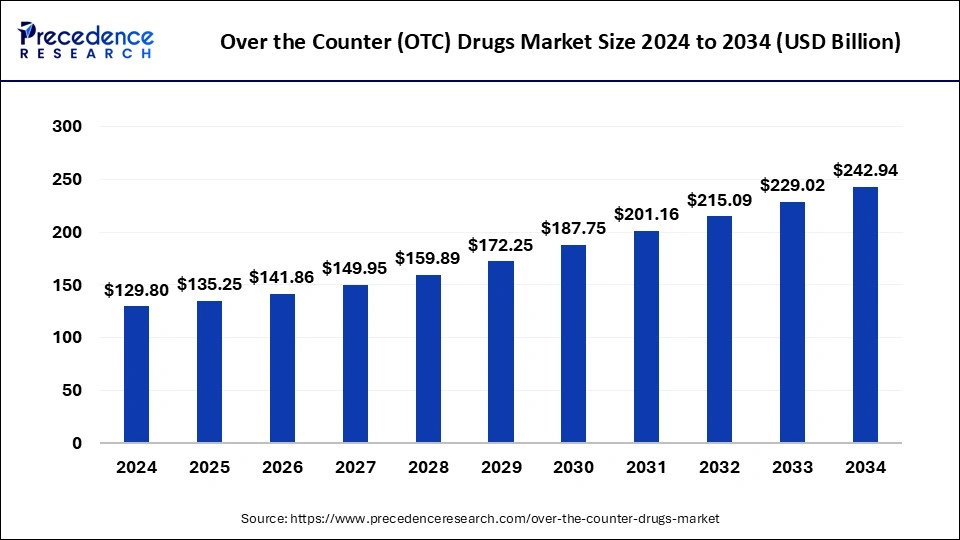

The global Over-the-Counter (OTC) drugs market is experiencing steady growth, driven by rising self-care awareness, digital health adoption, and the rapid expansion of e-commerce channels. According to Precedence Research, the market size was valued at USD 156.92 billion in 2024 and is projected to hit USD 242.94 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.44% between 2025 and 2034.

OTC Drugs Market Key Insights:

- The North America over the counter (OTC) drugs market size was valued at USD 39.77 billion in 2024.

- By route of administration, the oral segment has accounted for 56.66% revenue share in 2024.

- By route of administration, The parenteral segment has captured 20.24% market share in 2024.

OTC Drugs Market Overview

Over-the-Counter (OTC) drugs are non-prescription medications that consumers can purchase directly without visiting a doctor. These medicines are commonly used to manage everyday health concerns such as colds, fever, headaches, body pain, allergies, digestive discomfort, and minor skin issues. By providing quick relief for common conditions, OTC drugs play a vital role as first-line treatments, helping reduce unnecessary doctor visits and overall healthcare costs.

One of the key strengths of OTC drugs is their easy accessibility. They are widely available across pharmacies, supermarkets, convenience stores, and increasingly through online pharmacies, making them highly convenient for consumers. In addition, their affordability and proven effectiveness make them a trusted choice for millions worldwide.

The OTC market offers a broad range of product formats, including tablets, capsules (hard and soft), powders, ointments, and topical applications, catering to diverse consumer needs and preferences. This variety ensures that individuals can find the most suitable and convenient form of medication for their lifestyle.

OTC Drugs Market Size Analysis (USD Million) from 2022 to 2024

OTC Drugs Market Size Analysis (USD Million) By Product 2022-2024

| Product | 2022 | 2023 | 2024 |

| Vitamin and Dietary Supplements | 58,668.36 | 61,042.45 | 63,623.01 |

| Cough and Cold Products | 16,345.25 | 16,972.87 | 17,655.23 |

| Analgesics | 14,882.98 | 15,408.28 | 15,979.84 |

| Gastrointestinal Products | 8,201.19 | 8,507.62 | 8,840.83 |

| Sleep Aids | 4,936.54 | 4,998.45 | 5,069.94 |

| Otic Products | 3,473.40 | 3,520.5 | 3,574.55 |

| Wart Removers | 3,385.12 | 3,420.5 | 3,462.40 |

| Mouth Care Products | 3,353.20 | 3,416.06 | 3,486.15 |

| Ophthalmic products | 2,534.92 | 2,524.77 | 2,519.02 |

| Botanicals | 2,271.15 | 2,269.10 | 2,270.99 |

| Smoking Cessation Products | 1,249.98 | 1,283.76 | 1,320.74 |

| Feminine Care | 1,017.06 | 1,032.97 | 1,050.95 |

| Others | 810.83 | 882.55 | 943.76 |

OTC Drugs Market Size Analysis (USD Million) By Distribution Channel 2022-2024

| Distribution Channel | 2022 | 2023 | 2024 |

| Hospital Pharmacies | 21,144.66 | 21,934.69 | 22,793.80 |

| Retail Pharmacies | 50,963.66 | 52,657.00 | 54,501.18 |

| Online Pharmacies | 15,246.55 | 15,847.75 | 16,501.29 |

| Others | 33,775.13 | 34,840.55 | 36,001.13 |

What are Popular Over the Counter Drugs?

| OTC Drugs | Use | Dosage Forms |

| Acetaminophen |

|

|

| Ibuprofen |

|

|

| Fexofenadine |

|

|

| Loratadine |

|

|

| Hydrocortisone Creams |

|

|

| Dextromethorphan |

|

|

OTC Drugs Market Opportunity

Rising Self-Care Trend Unlocks Growth Potential

The Over-the-Counter (OTC) drugs market is witnessing strong growth, fueled by the global shift toward self-care and preventive healthcare. Consumers today are more informed about their health, with easy access to medical knowledge and treatment options through smartphones and the internet. This growing awareness is encouraging individuals to self-diagnose minor ailments such as colds, headaches, and digestive issues, leading to greater reliance on OTC medications.

The push for cost-effective healthcare solutions is another major driver. As healthcare expenses rise, more consumers are turning to OTC drugs as an affordable and convenient first-line treatment. The expansion of online pharmacies further boosts adoption, providing quick access to trusted brands and doorstep delivery.

Overall, the increasing consumer focus on self-management, proactive health monitoring, and preventive wellness is unlocking new opportunities for OTC drug manufacturers and retailers worldwide.

OTC Drugs Market Challenges

Side Effects and Misuse Limit Market Expansion

While OTC drugs offer clear benefits, their potential side effects remain a significant challenge to widespread adoption. The impact of these drugs varies across individuals, and misuse can result in mild to severe health risks. Common side effects may include drowsiness, dry mouth, increased heart rate, gastrointestinal issues, and allergic reactions. More severe complications, such as overdose, kidney damage, or liver damage, can occur with prolonged use or incorrect dosage.

The risk of drug interactions—especially when OTC medications are combined with prescription drugs—also limits their safe usage. Misuse among teenagers and young adults further exacerbates the problem, creating health risks that hinder overall market growth.

Although the market is expanding rapidly, addressing concerns around safe usage, consumer education, and proper dosage guidelines will be critical for sustaining growth in the coming years.

View Detailed Insight@ https://www.precedenceresearch.com/over-the-counter-drugs-market

OTC Drugs Market Report Scope

| Report Attributes | Key Statistics |

| Market Size In 2025 | USD 129.80 Billion |

| Market Size In 2025 | USD 135.25 Billion |

| Market Size by 2034 | USD 242.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Leading Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segment Covered | Product, Dosage Form, Route of Administration, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Leading Companies Covered | Bayer AG, Takeda Pharmaceutical Company Ltd., Pfizer, Johnson & Johnson Services Inc., Sanofi S.A., Reckitt Benckiser Group PLC, Novartis AG, Boehringer Ingelheim International GmbH, GlaxoSmithKline PLC, Mylan. |

Over-the-Counter Drugs (OTC) Market – Regional Insights

How Big is the U.S. OTC Drugs Market?

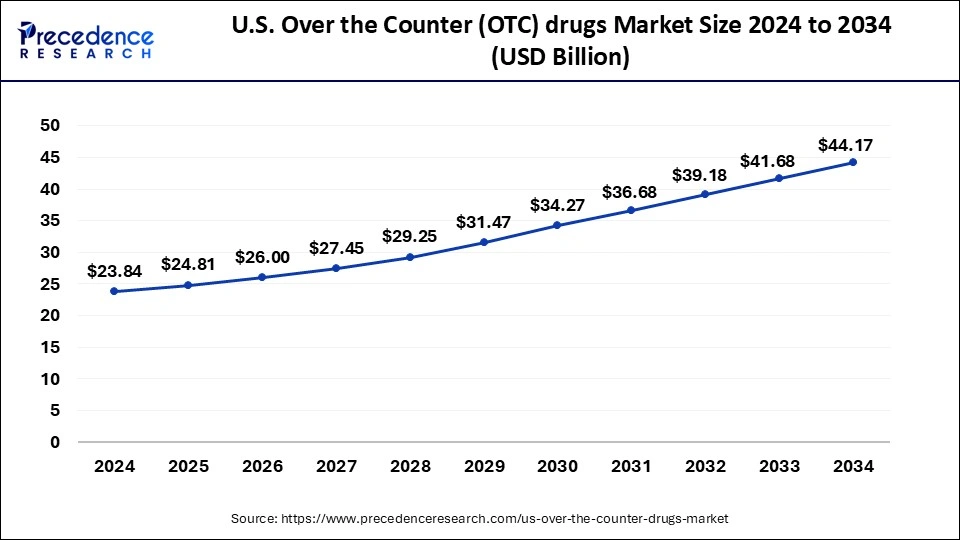

The U.S. over-the-counter (OTC) drugs market was valued at USD 39.77 billion in 2024 and is projected to nearly double, reaching USD 75.93 billion by 2034, expanding at a CAGR of 6.94% from 2025 to 2034.

North America dominated the global OTC market in 2024, driven by strong consumer demand for self-treatment of common health issues such as pain, colds, and allergies. A well-established retail ecosystem—including pharmacies, supermarkets, and rapidly growing e-commerce platforms—continues to support market growth. Additionally, a favorable regulatory environment led by the U.S. Food and Drug Administration (FDA) is encouraging consumer trust and wider adoption of OTC medicines.

Europe OTC Drugs Market Outlook

Europe is also experiencing steady growth in the OTC sector. The rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, and arthritis is increasing the demand for non-prescription medicines. Furthermore, greater awareness of self-medication, coupled with the rise of online pharmacies and digital health platforms, is creating new opportunities across the region. Preventive healthcare trends, particularly the demand for vitamin supplements and wellness products, are further boosting adoption.

Also Read @ Artificial Intelligence in Healthcare Market to Transform Global Care Delivery

Over-the-Counter Drugs (OTC) Market Segmentation

Product Insights

-

Cold & Cough Products: In 2024, cold and cough remedies held a significant market share. Rising incidences of seasonal flu and respiratory issues among children and the elderly continue to drive sales. Widely trusted products such as pain relievers, decongestants, and cough suppressants—produced by major players like GSK, Bayer, and Cipla—are further supporting market growth.

-

Vitamins & Dietary Supplements: This segment is projected to be the fastest-growing category through 2034. Consumers are increasingly turning to supplements for boosting immunity, enhancing cognitive health, and improving sleep cycles. The rise of personalized nutrition and convenient access via e-commerce platforms is accelerating demand.

Dosage Form Insights

-

Tablets: Tablets dominated the market in 2024 due to their affordability, accurate dosing, and long shelf life. Their convenience makes them the preferred format for consumers managing chronic conditions and everyday ailments.

-

Ointments: Expected to grow at the fastest pace, ointments are witnessing strong demand due to the rising prevalence of musculoskeletal pain and dermatological issues. Increasing consumer preference for home-based care and easy availability through both physical and online pharmacies contribute to this growth.

Route of Administration Insights

-

Oral Medications: The oral segment accounted for the largest share in 2024. Easy availability of oral formulations such as tablets, capsules, and syrups across drugstores, grocery outlets, and online platforms has fueled consumer adoption.

-

Topical Medications: Projected to record the fastest growth, topical drugs are gaining traction for the treatment of skin conditions such as acne, eczema, and psoriasis, as well as for applications in cosmetic dermatology and pain management.

Distribution Channel Insights

-

Drug Stores & Retail Pharmacies: This segment remained the leading distribution channel in 2024. Local pharmacies continue to attract consumers due to convenience, accessibility, and the presence of pharmacists offering product guidance.

-

Online Pharmacies: E-commerce is the fastest-growing channel for OTC drugs, fueled by the increasing demand for 24/7 access, doorstep delivery, competitive pricing, and personalized product recommendations. The surge in smartphone usage and consumer comfort with digital health platforms are expected to accelerate this trend in the years ahead.

OTC Drugs Market Top Companies

- Bayer AG

- Takeda Pharmaceutical Company Ltd.

- Pfizer

- Johnson & Johnson Services Inc.

- Sanofi S.A.

- Reckitt Benckiser Group PLC

- Novartis AG

- Boehringer Ingelheim International GmbH

- GlaxoSmithKline PLC

- Mylan

OTC Drugs Market Segments Covered in the Report

By Product

- Vitamin and Dietary Supplements

- Cough & Cold Products

- Analgesics

- Gastrointestinal Products

- Sleep Aids

- Otic Products

- Wart Removers

- Mouth Care Products

- Ophthalmic Products

- Botanicals

- Smoking Cessation Products

- Feminine Care

- Others

By Dosage Form

- Tablets

- Hard Capsules

- Powders

- Ointments

- Soft Capsules

- Liquids

- Others

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- MEA

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- GLP-1 Analogues Market Set to Surpass USD 879.9 Billion by 2034, Driven by Rising Diabetes and Obesity Rates - September 2, 2025

- Gift Cards Market Size to Achieve USD 3.81 Trillion by 2034, Driven by Digital Payments and E-Commerce Growth - September 1, 2025

- Surgical Snare Market: How AI and Minimally Invasive Surgery Are Shaping the Future - September 1, 2025