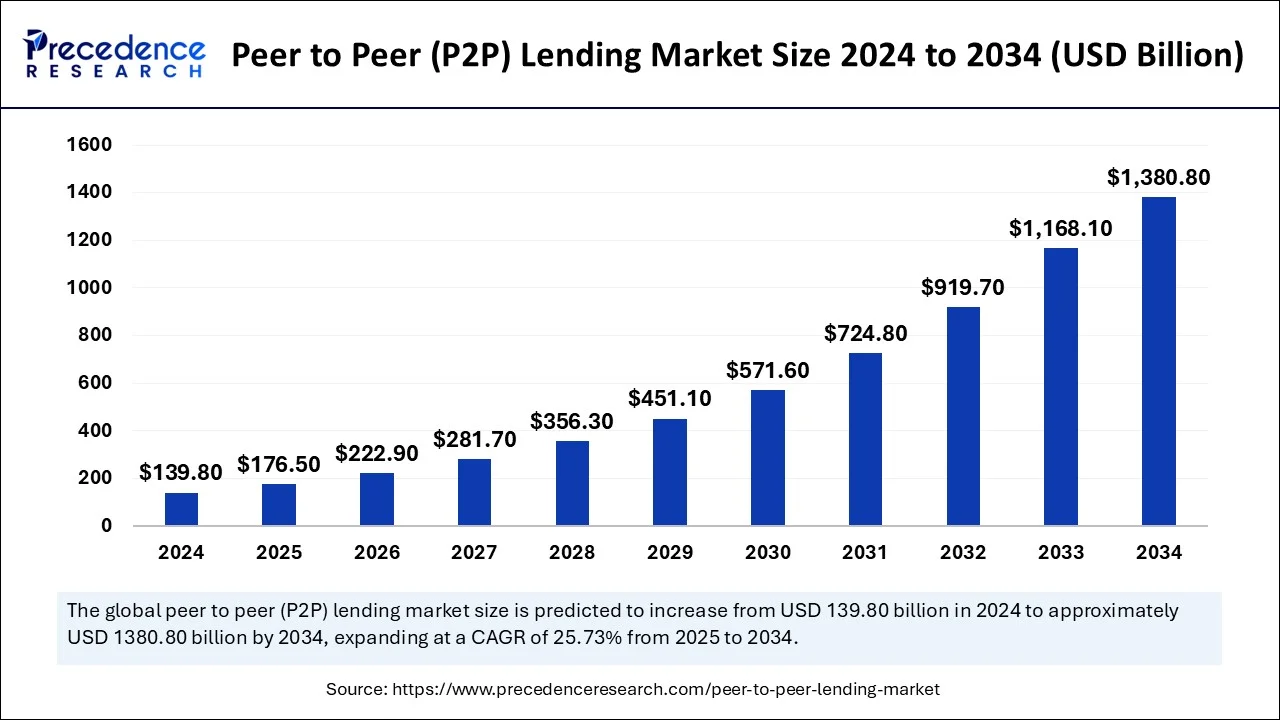

Peer-to-Peer (P2P) Lending Market to Surpass USD 1,380.80 Billion by 2034 Fueled by Fintech Innovation and Digital Transformation

The global peer-to-peer (P2P) lending market is entering a high-growth phase, projected to expand from USD 176.5 billion in 2025 to more than USD 1,380.80 billion by 2034. According to Precedence Research, this reflects an impressive CAGR of 25.73% between 2025 and 2034.

The surge is being driven by accelerating digitalization, rapid adoption of fintech platforms, and growing demand for alternative financing solutions that bypass traditional banks. Borrowers are increasingly seeking fast, cost-effective funding, while investors are drawn to higher returns compared with conventional savings products.

What is Peer-to-Peer Lending?

Peer-to-peer lending (P2P lending) is a digital financial model that connects borrowers directly with lenders through online platforms, eliminating banks as intermediaries. Borrowers gain access to affordable and timely loans, while investors benefit from competitive returns.

The rise of P2P lending is closely linked to global financial digitalization, expanding internet penetration, and the need for inclusive financing models. It has proven to be a disruptive alternative to traditional lending, offering transparency, accessibility, and efficiency—especially for underserved populations and SMEs.

Key Market Highlights

-

The global P2P lending market is expected to grow from USD 176.5 billion in 2025 to USD 1,380.80 billion by 2034.

-

CAGR is projected at 25.73% during the forecast period.

-

North America held the largest share in 2024 (37%), with the U.S. capturing over 63% of the regional market.

-

Asia Pacific will expand at a strong CAGR of 25.52% from 2025 to 2034, driven by digital adoption and fintech-friendly regulations.

-

By business model, the traditional lending segment held the largest share in 2024, while marketplace lending is expected to grow fastest.

-

By loan type, consumer lending dominated in 2024, while business lending will see the fastest CAGR during 2025–2034.

Market Size Trends (2022–2024)

By Type (USD Billion):

-

Consumer Lending: 55.2 (2022) → 87.6 (2024)

-

Business Lending: 32.8 (2022) → 52.2 (2024)

By End User (USD Billion):

-

Consumer Credit Loans: 31.0 (2022) → 49.2 (2024)

-

Small Business Loans: 23.5 (2022) → 37.4 (2024)

-

Student Loans: 19.1 (2022) → 30.1 (2024)

-

Real Estate Loans: 14.4 (2022) → 29.4 (2024)

By Business Model (USD Billion):

-

Marketplace Lending: 38.7 (2022) → 61.5 (2024)

-

Traditional Lending: 49.3 (2022) → 78.3 (2024)

📥 Immediate Delivery Available | Buy This Premium Report

Emerging Trends Shaping the Peer-to-Peer Lending Market

- Smarter Credit Risk Assessment through AI

Peer-to-peer platforms are increasingly deploying AI and machine learning models to analyze borrower data in real time. These tools help reduce defaults, improve underwriting accuracy, and create more personalized lending experiences. - Blockchain-Powered Transparency

Blockchain is transforming P2P lending by ensuring tamper-proof transactions, lowering fraud risk, and enabling automated smart contracts that streamline the lending process. - Growth of Specialized Lending Platforms

Niche P2P platforms are gaining traction by focusing on specific borrower groups such as students, small businesses, and sustainability-driven projects, creating customized solutions that attract targeted investors. - Fintech Ecosystem Integration

P2P lending is no longer standalone—it is being bundled with digital wallets, neobanking platforms, and robo-advisory services, creating seamless user experiences and driving mass adoption. - Institutional Capital Flowing In

Beyond retail investors, hedge funds, banks, and asset managers are increasingly participating in P2P lending platforms, boosting liquidity and lending credibility. - Rise of Global and Cross-Border Lending

The globalization of P2P platforms is opening doors to cross-border lending, enabling investors to fund borrowers in emerging markets while diversifying their portfolios. - Evolving Regulatory Frameworks

Governments worldwide are introducing stricter compliance norms to safeguard investor confidence and protect borrowers. While this raises operational complexity, it also strengthens trust in the long run.

View Detailed Report@ https://www.precedenceresearch.com/peer-to-peer-lending-market

Growing Role of Social Impact Investing in the P2P Lending Market

The peer-to-peer (P2P) lending market is increasingly aligning with the global rise of social impact investing—a model where capital is directed not only for financial returns but also to generate measurable, positive social outcomes. This shift is opening new growth avenues for P2P platforms that prioritize sustainability and inclusivity.

Modern P2P platforms are well-positioned to connect socially conscious investors with borrowers in areas that traditional banking often overlooks. These opportunities include small businesses in underserved communities, renewable energy ventures, educational programs, and microloans for entrepreneurs in developing nations. By facilitating such purpose-driven investments, P2P platforms not only expand financial access but also empower local economies and accelerate global sustainability goals.

As ethical investing and sustainability trends gain momentum worldwide, P2P lending platforms that integrate impact-focused lending opportunities are expected to stand out in an increasingly competitive market. By catering to a new class of impact-oriented investors, these platforms can secure long-term growth while simultaneously contributing to broader societal progress.

Major Challenges in the Peer-to-Peer (P2P) Lending Market

Credit Risk Concentration and Platform Vulnerability

One of the most pressing challenges in the peer-to-peer (P2P) lending market is the issue of credit risk concentration. When a platform becomes heavily exposed to a specific group of borrowers, industries, or geographic regions, it creates significant vulnerability. Such concentration increases the likelihood of defaults if external shocks occur—whether from economic downturns, regulatory changes, or industry-specific disruptions.

Without strong risk diversification strategies and robust credit assessment frameworks, P2P platforms face reduced resilience and may struggle to maintain investor confidence. Over time, this could discourage new participants, constrain liquidity, and ultimately limit long-term market growth.

For sustainable expansion, platforms must adopt advanced risk management tools such as AI-driven credit scoring, diversified borrower portfolios, and dynamic monitoring systems to mitigate these inherent risks and safeguard both lenders and borrowers.

Peer-to-Peer (P2P) Lending Market – Key Regional Insights

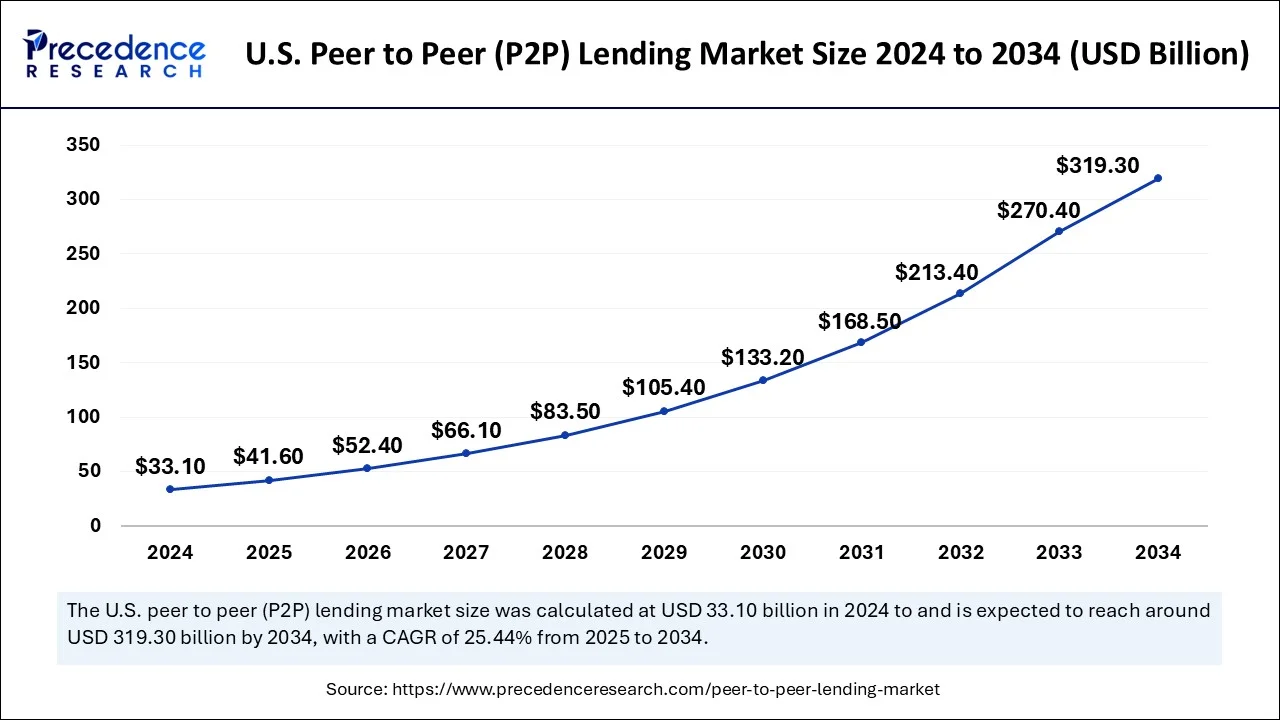

How Big is the U.S. P2P Lending Market?

The U.S. peer-to-peer (P2P) lending market is set for robust expansion. Valued at USD 41.60 billion in 2025, it is projected to reach nearly USD 319.3 billion by 2034, growing at a healthy CAGR of 25.44% during the forecast period. This surge reflects the country’s strong fintech adoption, tech-driven consumer finance ecosystem, and increasing investor participation in digital lending platforms.

📌 Note: The full report is available for immediate delivery. Download a Sample Report to explore detailed insights.

Why North America Leads the Global Market

North America dominated the global P2P lending market in 2024, holding the largest regional share. This leadership is attributed to the presence of well-established fintech companies, high levels of digital adoption, and a mature investor base that continues to fuel market growth.

Additionally, widespread awareness of alternative lending options and strong policy emphasis on financial inclusion have accelerated the adoption of P2P platforms. The region’s ability to provide a secure, transparent, and investor-friendly environment has further reinforced its leadership, attracting both institutional investors and individual participants.

Asia-Pacific – The Fastest-Growing Region

The Asia-Pacific P2P lending market is forecasted to grow at the fastest pace from 2025 to 2034, fueled by rapid digital transformation, SME growth, and government-backed financial inclusion initiatives.

-

China continues to dominate with its large-scale P2P ecosystem.

-

India shows immense potential as adoption of cashless payments, digital wallets, and online lending platforms accelerates.

A growing base of small and medium-sized enterprises (SMEs) in need of alternative financing is driving demand across the region. At the same time, pro-fintech government policies in emerging economies are boosting confidence in digital lending and ensuring that P2P platforms become an integral part of the financial ecosystem.

Peer-to-Peer (P2P) Lending Market Segmentation Analysis

Type Analysis

Why Did Consumer Lending Dominate the P2P Lending Market in 2024?

In 2024, the consumer lending segment captured the largest share of the peer-to-peer (P2P) lending market. This dominance stems from the rising demand for small, fast, and accessible personal loans. Borrowers are using P2P platforms to consolidate existing debts, finance home renovations, cover medical expenses, and fund education.

Younger generations and individuals with non-traditional credit histories find P2P lending particularly attractive because the application process is simpler, requires fewer documents, offers quick disbursement, and often provides more competitive interest rates compared with traditional banks.

The convenience and accessibility of P2P lending have cemented consumer loans as the most prevalent category, allowing borrowers to bypass rigid banking systems while enabling investors to earn steady and consistent returns.

Meanwhile, the business lending segment is forecasted to grow at the fastest rate during 2025–2034. Small and medium-sized enterprises (SMEs) are increasingly turning to P2P platforms for flexible financing solutions. Fintech-driven risk assessment models and tailored loan products are accelerating SME adoption. Additionally, government support for entrepreneurship and digital finance in emerging economies is expected to make P2P business lending one of the primary growth drivers of innovation and economic activity in the financial sector.

End User Analysis

Which End-Use Segment Held the Largest Share of the P2P Lending Market?

In 2024, the consumer credit loans segment led the P2P lending market. This dominance is tied to its predictability—scheduled payments provide investors with stable returns and lower default risks. The wide borrower base includes individuals financing lifestyle expenses as well as those refinancing existing debts.

Consumer credit loans also typically involve smaller loan amounts and shorter repayment terms, which lowers the likelihood of financial disruption and default. Their reliability and the streamlined approval processes offered by digital P2P platforms make them the most validated and widely used application globally.

The student loans segment, however, is expected to register the fastest growth during the forecast period. With the cost of higher education rising worldwide, students—especially in developing economies—are seeking alternative financing solutions outside traditional banking. P2P platforms provide a flexible, accessible, and faster option, often with fewer documentation requirements and more favorable lending conditions.

For investors, student loans are appealing because of their longer repayment periods, which create predictable income streams. In addition, many student loan programs are partially subsidized or backed by governments, further reducing default risks and strengthening investor confidence.

Business Model Analysis

Why Did Traditional Lending Dominate the P2P Lending Market in 2024?

The traditional lending model accounted for the largest market share in 2024. This model is favored because it is straightforward and widely trusted: platforms act solely as intermediaries, connecting borrowers and lenders without assuming ownership of the loans themselves.

By minimizing the role of financial intermediaries, traditional lending appeals to both investors and borrowers who want to avoid the constraints of traditional banks. Its simplicity also makes it easier for platforms to scale operations, remain cost-effective, and comply with regulatory standards.

On the other hand, the marketplace lending model is expected to grow at the fastest pace over the coming decade. This growth is being fueled by technological innovation and increasing involvement from institutional investors. AI-powered credit scoring, advanced fraud detection systems, and real-time repayment tracking are improving risk management and efficiency.

As demand for global digital lending solutions rises, marketplace lending is evolving into a tech-enabled, investor-friendly model that offers transparency, scalability, and attractive returns, positioning it as a key driver of the next phase of P2P market growth.

Peer to Peer (P2P) Lending Market Companies

- Avant LLC

- Zopa Bank Limited

- Funding Circle

- Social Finance Inc.

- Kabbage Inc.

- RateSetter

- Lending Club Corporation

- Prosper Funding LLC

- LendingTree LLC

- OnDeck

Recent Developments

- July17, 2025- Funding Circle, once a retail peer to peer lending pioneer, has staged a notable comeback. The UK- based platform extended substantially more credit in the first half of 2025 compared to the prior year, translating into a return to profitability after restructuring and existing the U.S. market. Under new leadership, the company reversed a sizable loss into a modest profit and is on track to boost its pre-tax profits and revenues by 2026. This turnaround underscores renewed investor confidence and the firm’s shift toward institutional funding models.

- June 12, 2025- The Carlyle Group has joined with Citigroup to roll asset backed financing specially targeted at fintech lenders. This initiative aims to meet escalating demand for scalable funding solutions within the P2P and fintech lending sectors. By combining Carlyle’s infrastructure financing expertise and Citi’s extensive private credit capabilities, the partnership signals strong institutional confidence in fintech’s growth and opens new funding pathways for emerging lending platforms.

Recent Developments

- In January 2025, LenDenClub, a prominent P2P lending platform announced the launch of a new daily earning loan that allows lenders to earn daily interest with principal repayments. With this offering, lenders and investors can get a choice of loans starting from nine months tenure.

- In October 2024, IndiaP2P launched a new version of its services, the Monthly Income Plan-Plus. This offering adheres to the RBIs updated and faster settlement guidelines for P2P lending. Under this offering, lenders can earn up to 18% per annum interest with monthly payouts.

- In December 2024, Defender Global announced the launch of P2P lending platform while securing $235,000 for real-world projects. The company has settled the aim to position itself to meet the rising demand for asset-backed and accessible investment.

Segments Covered in the Report

By Type

- Consumer Lending

- Business Lending

By End User

- Consumer Credit Loans

- Small Business Loans

- Student Loans

- Real Estate Loans

By Business Model

- Marketplace Lending

- Traditional Lending

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- India Eyes Rare Earth Partnership With Myanmar to Reduce Reliance on China - September 10, 2025

- Apple iPhone 17 Pro Max vs iPhone 17 Pro vs Samsung Galaxy S25 Ultra: Ultimate 2025 Flagship Comparison - September 10, 2025

- Israel and India Sign Investment Deal Amid Gaza War Controversy - September 9, 2025