Surgical Snare Market: How AI and Minimally Invasive Surgery Are Shaping the Future

Surgical Snare Market Overview

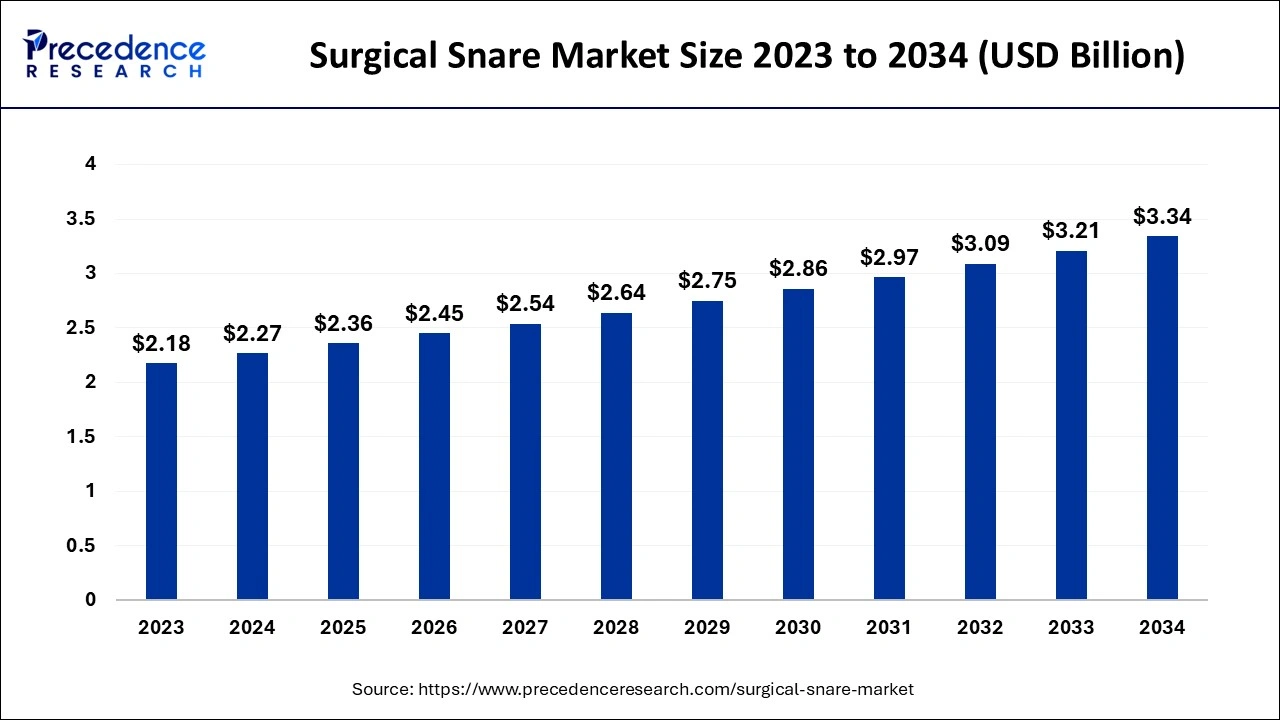

The global surgical snare market size was estimated at USD 2.27 billion in 2024 and is projected to surpass USD 3.34 billion by 2034, growing at a CAGR of 3.94% from 2025 to 2034. The rising prevalence of gastrointestinal (GI) conditions such as colorectal cancer and polyps is driving demand for minimally invasive procedures like polypectomy and tumor removal, where surgical snares play a crucial role.

Surgical snares are now considered indispensable in endoscopic procedures due to their precision, safety, and compatibility with advanced surgical systems. Growing healthcare investments, AI-driven innovations, and a rising burden of chronic diseases are fueling the global adoption of these devices.

Surgical Snare Market Key Takeaways

- The global surgical snare market was valued at USD 2.27 billion in 2024.

- It is projected to reach USD 3.34 billion by 2034.

- The surgical snare market is expected to grow at a CAGR of 3.94% from 2025 to 2034.

- North America dominated the global market with the largest market share of 45% in 2024.

- Asia Pacific is observed to be the fastest growing region during the forecast period.

- By usability, the single-use segment contributed the highest market share of 62% in 2024.

- By usability, the reusable segment is expected to witness the fastest CAGR during the forecast period.

- By application, the GI endoscope segment held the largest market share of 32% in 2024.

- By application, the arthroscopy segment is anticipated to grow at the fastest CAGR during the forecast period.

- By end-use, the hospitals segment accounted for the biggest market share of 78% in 2024.

- By end-use, the ambulatory surgical centers segment is observed to grow rapidly during the forecast period.

Surgical Snare Market Size (2025–2034)

-

Market size in 2024: USD 2.27 Billion

-

Projected market size by 2034: USD 3.34 Billion

-

CAGR (2025–2034): 3.94%

-

Largest Market (2024): North America (45% share)

-

Fastest Growing Region: Asia Pacific

How AI is Transforming the Surgical Snare Market

Artificial Intelligence is reshaping surgical snare adoption by enhancing accuracy and safety. AI-integrated endoscopic systems can:

-

Differentiate healthy from abnormal tissue in real-time.

-

Optimize snare performance based on tissue density and structure.

-

Reduce complications such as bleeding and perforation.

-

Provide post-operative verification by analyzing biopsy or imaging data.

Notably, Medtronic’s GI Genius module, powered by AI, is a breakthrough in polyp detection and colorectal cancer prevention.

Market Dynamics

Drivers

-

Rising gastrointestinal procedures (colonoscopy, polypectomy, biopsies).

-

Technological advancements in snare designs (hybrid & bipolar snares).

-

Growing awareness of minimally invasive surgeries.

Restraints

-

High product costs (single-use snares and advanced materials).

-

Limited infrastructure in developing nations.

Opportunities

-

Increasing cancer screening and awareness programs.

-

Adoption of robotic-assisted surgeries and AI-enabled devices.

-

Rising demand for outpatient and ambulatory surgical care.

View Market Insights@ https://www.precedenceresearch.com/surgical-snare-market

Segments Covered in the Surgical Snare Market Report

By Usability

Why do Single-Use Surgical Snares dominate the market?

Single-use surgical snares accounted for the largest market share in 2024, contributing around 62% of the revenue. Their dominance is attributed to sterility, infection control, and convenience, as they are pre-sterilized and discarded after one procedure. This eliminates the risk of cross-contamination and reduces the burden of sterilization, which is crucial in hospitals and endoscopy centers. With growing awareness about hospital-acquired infections (HAIs), healthcare providers increasingly prefer disposable solutions, ensuring patient safety and compliance with strict hygiene protocols.

Why are Reusable Surgical Snares gaining traction?

Although single-use snares dominate, the reusable segment is projected to grow at the fastest CAGR during 2025–2034. Hospitals and clinics view reusable snares as a cost-effective solution, especially in high-volume surgical centers. With proper sterilization, these snares can be used multiple times, significantly lowering the cost per procedure. Advancements in durable materials and ergonomic designs are making reusable snares safer and more efficient. This trend is especially strong in regions with constrained healthcare budgets, where cost-effectiveness is critical.

By Application

Why is the GI Endoscope segment leading the market?

The GI endoscope segment held the largest share (32%) in 2024. The rising prevalence of colorectal cancer, polyps, and gastrointestinal disorders has made colonoscopies and endoscopies routine medical practices worldwide. Surgical snares are crucial for polypectomy, biopsy, and tissue excision during these procedures. Increased awareness, coupled with government-backed screening programs for early cancer detection, is further accelerating demand for GI endoscope snares.

How is Laparoscopy influencing surgical snare adoption?

Laparoscopic procedures are becoming increasingly popular due to their minimally invasive nature, shorter recovery times, and reduced complications. In laparoscopic surgeries, surgical snares are used for tissue removal and biopsy collection. Rising adoption of laparoscopy in gynecology, urology, and oncology is strengthening the demand for surgical snares tailored for these applications.

Why is Urology Endoscopy a growing application segment?

Urology endoscopy is expanding due to the rising incidence of kidney diseases, urinary tract infections, and bladder cancer. Surgical snares are frequently used for stone removal, biopsy, and tumor excision in the urinary tract. Growing patient preference for minimally invasive treatments, coupled with technological advancements in urological endoscopes, is expected to boost demand in this segment.

What role does Gynecology Endoscopy play in market growth?

Gynecology endoscopy procedures, including hysteroscopy and laparoscopy, are increasingly performed for infertility evaluation, fibroid removal, and cancer screening. Surgical snares are employed to extract abnormal tissue or perform biopsies with minimal damage. With rising awareness about women’s health and reproductive disorders, this segment is expected to grow steadily.

Why is Arthroscopy one of the fastest-growing applications?

The arthroscopy segment is anticipated to register the fastest CAGR during the forecast period. Aging populations worldwide are experiencing higher rates of joint disorders and arthritis, necessitating minimally invasive orthopedic procedures. Surgical snares are used in arthroscopy to remove soft tissue, loose cartilage, or foreign objects from joints. Recent advancements, such as snares with improved flexibility and precision, are supporting growth in this segment.

How does Bronchoscopy contribute to surgical snare demand?

Bronchoscopic procedures use surgical snares to remove foreign bodies, excise tumors, and collect biopsies from the respiratory tract. The rising prevalence of lung cancer and chronic respiratory conditions is fueling growth in this segment. Additionally, percutaneous lung biopsy procedures are becoming more common, increasing the need for precise and reliable snare instruments.

What about Mediastinoscopy, Laryngoscopy, and Other Applications?

-

Mediastinoscopy: Used for tissue sampling in the chest area, particularly for diagnosing lymph node conditions and thoracic cancers.

-

Laryngoscopy: Involves snares for vocal cord lesion removal and biopsy collection, with rising demand due to increasing ENT procedures.

-

Others: Includes endoscopic procedures across multiple specialties where snares provide minimally invasive tissue removal options. Collectively, these applications expand the versatility of surgical snares across diverse clinical practices.

By End-Use

Why do Hospitals dominate the surgical snare market?

Hospitals accounted for 78% of the market share in 2024, making them the largest end-use segment. This dominance is due to their high patient volume, advanced infrastructure, and ability to perform complex surgeries. Hospitals typically serve as referral centers for cancer, GI disorders, and chronic diseases, all of which require endoscopic procedures involving snares. Furthermore, hospitals invest in advanced surgical instruments, ensuring greater adoption of both single-use and reusable snares.

Why are Ambulatory Surgical Centers (ASCs) growing rapidly?

Ambulatory surgical centers are expected to witness rapid growth during the forecast period. Patients prefer ASCs for cost-effective, outpatient-friendly procedures with quicker recovery times. Chronic conditions like colorectal cancer, obesity, and kidney diseases are being increasingly managed in these centers through endoscopic and minimally invasive surgeries. As healthcare systems worldwide shift toward outpatient care models, ASCs are set to become a crucial growth driver for the surgical snare market.

Surgical Snare Market Regional Analysis:

Why is North America the largest market for surgical snares?

North America dominated the global surgical snare market with a 45% share in 2024 and is projected to maintain leadership through 2034. The U.S. market alone was valued at USD 710 million in 2024, expected to surpass USD 1.08 billion by 2034 at a CAGR of 4.28%.

Several factors drive this dominance:

-

Advanced healthcare infrastructure supports the widespread use of minimally invasive surgeries.

-

High healthcare expenditure and reimbursement policies make premium devices accessible.

-

Presence of leading manufacturers such as Boston Scientific, Medtronic, and Olympus ensures strong supply chains and continuous innovation.

-

Government-funded cancer screening programs (like colorectal cancer screening) boost demand for endoscopic procedures using snares.

-

Rapid adoption of AI-powered endoscopy modules, such as Medtronic’s GI Genius, highlights the region’s focus on innovation.

North America’s early adoption of robotic-assisted surgeries and integration of AI ensures the market remains robust, with hospitals and ambulatory surgical centers both contributing strongly.

How is Europe shaping its surgical snare market?

Europe represents a mature yet steadily growing market for surgical snares, supported by well-established healthcare systems and regulatory frameworks. Key contributors include Germany, France, the U.K., and Italy, where colorectal cancer screening and early diagnostic procedures are highly emphasized.

Growth factors include:

-

Government-backed cancer prevention initiatives (e.g., EU-wide colorectal screening).

-

Increased adoption of minimally invasive surgeries to reduce hospital stays and costs.

-

Investments in training programs for endoscopic specialists across the region.

-

Strong regulatory approvals for advanced medical devices, ensuring consistent adoption of innovative snares.

Europe’s market outlook remains positive, especially as healthcare providers continue shifting toward outpatient and day-care endoscopy centers, creating demand for both single-use and reusable snares.

Why is Asia Pacific the fastest-growing market?

Asia Pacific is projected to grow at the fastest CAGR during 2025–2034, making it the key growth frontier for surgical snares. Rapid urbanization, an expanding middle-class population, and rising healthcare expenditure in China, India, Japan, and South Korea are reshaping the market landscape.

Key drivers:

-

Rising cancer prevalence — colorectal and gastrointestinal cancers are increasingly common, particularly in China and India.

-

Expanding healthcare infrastructure with investments in endoscopy units and cancer treatment centers.

-

Cost advantages in manufacturing and adoption, making devices more affordable compared to Western markets.

-

Increasing popularity of medical tourism in countries like India, Thailand, and Singapore, where endoscopic procedures are performed at lower costs.

-

Strong government initiatives for early detection and prevention of GI diseases.

The adoption of AI-enabled diagnostic tools is still emerging in this region but is expected to accelerate as global players expand partnerships with local healthcare systems.

What is the growth potential in Latin America?

Latin America is an emerging but promising market for surgical snares, with Brazil, Mexico, and Argentina as key contributors. The market is driven by:

-

Growing prevalence of colorectal cancer and obesity-related GI disorders.

-

Gradual improvement in public and private healthcare investments.

-

Expanding network of specialized diagnostic and surgical centers.

-

Increased awareness of preventive healthcare and cancer screening programs.

However, challenges remain in the form of uneven healthcare access, economic constraints, and reliance on imports for advanced surgical devices. Despite these hurdles, Latin America presents growth opportunities as more middle-income populations gain access to minimally invasive surgeries.

How is the Middle East & Africa market evolving?

The Middle East & Africa (MEA) region currently accounts for a smaller share but is witnessing steady growth due to rising healthcare investments and improved diagnostic capabilities. Key markets include Saudi Arabia, the UAE, and South Africa.

Growth factors include:

-

Government spending on modern healthcare facilities, especially in the Gulf Cooperation Council (GCC) countries.

-

Increasing prevalence of cancer and GI disorders linked to changing lifestyles.

-

Adoption of medical tourism hubs (Dubai, Abu Dhabi) where advanced endoscopic procedures are offered.

-

Collaborations with global medical device companies to enhance accessibility.

However, challenges such as limited infrastructure in rural areas and dependence on imports hinder rapid adoption. Nonetheless, MEA remains a growth-ready market, especially in urban healthcare ecosystems.

Which region presents the strongest growth opportunity?

-

North America will remain the market leader, powered by innovation, AI integration, and high spending power.

-

Europe will continue growing steadily with a focus on cancer prevention and early detection.

-

Asia Pacific is the most dynamic growth region, with increasing patient volume, healthcare expansion, and medical tourism.

-

Latin America and MEA present long-term opportunities as healthcare infrastructure and awareness programs strengthen.

Surgical Snare Market Concentration and Ecosystem Analysis

How concentrated is the Surgical Snare Market?

The global surgical snare market is moderately concentrated, dominated by a handful of multinational medical device manufacturers. Leading companies such as Medtronic, Olympus, and Boston Scientific collectively hold a significant share of the global market, especially in North America and Europe.

-

Top 3 players (Medtronic, Olympus, Boston Scientific): Account for nearly 40–45% of the market share.

-

Mid-tier players (CONMED, Steris, Merit Medical, Cook): Represent the next 30–35%, focusing on specialized applications and regional expansions.

-

Smaller and niche companies (Avalign, Sklar Surgical, Medline): Compete by offering cost-effective solutions, distribution strength, or niche product portfolios.

This moderate concentration means innovation is driven by large-scale R&D investments from global leaders, while smaller firms compete on price, customization, and regional presence.

- Medtronic

- Olympus Corporation

- Merit Medical Systems

- Avalign Technologies

- Hill-Rom Holdings, Inc.

- Sklar Surgical Instruments

- Cook

- CONMED Corporation

- Steris (U.S.)

- Boston Scientific Corporation

- Medline Industries, Inc.

Also Read@ Next-Generation RNA Therapeutics Market: Transforming Drug Discovery and Precision Medicine

What roles do the leading companies play in the ecosystem?

1. Medtronic

-

A global leader in medical technology, heavily investing in AI-assisted endoscopy (GI Genius) and robotic-assisted surgery (Hugo system).

-

Focuses on innovation-driven differentiation, leveraging partnerships with tech leaders like NVIDIA.

-

Strong U.S. and global distribution network gives it dominance in high-value hospital contracts.

2. Olympus Corporation

-

A pioneer in endoscopic imaging and instruments, dominating the GI endoscope ecosystem.

-

Competitive edge lies in optical technology integration, combining endoscopes with snares for complete diagnostic-to-treatment solutions.

-

Strong presence in Asia Pacific and Europe, with ongoing focus on advanced visualization systems.

3. Boston Scientific Corporation

-

Known for single-use innovations such as the Versavue cystoscope, aimed at lowering infection risks.

-

Major player in gastroenterology and urology, targeting both hospital and ambulatory markets.

-

Expands through acquisitions and product diversification across minimally invasive procedures.

4. CONMED Corporation

-

Strong in orthopedic and sports medicine applications, especially arthroscopy.

-

Competes in surgical snares with focus on precision tools and surgeon-friendly devices.

-

Positions itself as a mid-tier but specialized competitor.

5. Steris (U.S.)

-

Market strength lies in sterilization technologies and infection prevention systems.

-

Complements the surgical snare market by offering complete sterile workflow solutions.

-

Well-positioned to capture growth in single-use snares segment.

6. Cook Medical

-

Focuses on gastroenterology and urology snares.

-

Known for cost-effective and reliable designs, making it competitive in emerging markets.

-

Expanding reach through distribution partnerships in Latin America and Asia Pacific.

7. Merit Medical Systems

-

Specializes in endoscopic tools and interventional procedures.

-

Competitive in customized product development and regional partnerships.

-

Strong focus on innovation in niche applications.

8. Avalign Technologies

-

Niche player, primarily an OEM (original equipment manufacturer) partner.

-

Supplies components and finished devices to larger brands.

-

Plays a critical role in the manufacturing side of the ecosystem.

9. Sklar Surgical Instruments

-

Known for broad catalog of surgical instruments, including snares.

-

Competes on affordability and wide distribution.

-

More prominent in secondary markets and surgical supply distribution.

10. Medline Industries, Inc.

-

A global distributor and supplier of medical devices, including surgical snares.

-

Competitive advantage: supply chain efficiency and hospital contracts.

-

Expands reach through bulk supply agreements and integration into hospital procurement systems.

Latest Announcements by Industry Leaders

- In February 2024, recently introduced in the United States by Boston Scientific Corp., the Versavue single-use flexible cystoscope may help lower the risk of infections in patients brought on by incorrect reprocessing of reusable cystoscopes.

- In March 2023, NVIDIA and Medtronic announced their partnership to speed up the advancement of AI in the healthcare sector and introduce innovative AI-based patient care solutions. Medtronic’s GI Genius cognitive endoscopy module, created and produced by Cosmo Pharmaceuticals, will use NVIDIA healthcare and edge AI technology. GI Genius is the first FDA-approved AI-assisted colonoscopy tool to assist doctors in identifying polyps that may develop into colorectal cancer.

Recent Developments

- In November 2024, In Shimla, the Indira Gandhi Medical College and Hospital (IGMC) began doing laparoscopic procedures for complicated cancers. The Department of Surgery has recently carried out laparoscopic procedures to treat stomach or its components removal, cancer in the food pipe, and rectal cancer.

- In May 2024, Medtronic plans to start more clinical research on its Hugo robotic-assisted surgery system to broaden its indications to include gynecology and hernias.

How does the Surgical Snare Ecosystem function?

The surgical snare ecosystem can be viewed across five layers:

-

Raw Material Suppliers

-

Provide stainless steel, tungsten wires, polymer coatings, and specialized medical-grade plastics.

-

Critical for manufacturing both disposable and reusable snares.

-

-

Device Manufacturers

-

Large players (Medtronic, Olympus, Boston Scientific) integrate snares into endoscopy systems.

-

Mid-sized and OEM players (Avalign, Sklar) manufacture standalone snares or components.

-

-

Technology Enablers

-

AI and imaging companies (NVIDIA collaborations, Edge-AI systems) enable real-time detection and precision.

-

Robotics integration enhances procedural accuracy.

-

-

Distributors and Suppliers

-

Companies like Medline ensure widespread availability in hospitals and ambulatory surgical centers.

-

Distribution partnerships expand into emerging regions.

-

-

End-Users (Hospitals & ASCs)

-

Hospitals: Largest buyers due to surgical volumes.

-

Ambulatory Surgical Centers: Growing rapidly with demand for outpatient procedures.

-

What trends define the competitive ecosystem?

-

AI Integration: Partnerships between medtech and tech giants (e.g., Medtronic + NVIDIA) are reshaping diagnostics and surgical precision.

-

Single-use vs. Reusable Balance: Infection control favors disposables, while cost pressure boosts reusables.

-

Regional Customization: Western players focus on high-tech innovations, while smaller firms compete in emerging markets with affordable solutions.

-

M&A Activity: Market leaders expand via strategic acquisitions to capture niche technologies and regional presence.

-

Sustainability Push: Reusable snares gaining traction as hospitals look to reduce medical waste and operational costs.

Segments Covered in the Report

By Usability

- Single Use

- Reusable

By Application

- GI Endoscope

- Laparoscopy

- Urology Endoscopy

- Gynecology Endoscopy

- Arthroscopy

- Bronchoscopy

- Mediastinoscopy

- Laryngoscopy

- Others

By End-Use

- Hospitals

- Ambulatory Surgical Centers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- GLP-1 Analogues Market Set to Surpass USD 879.9 Billion by 2034, Driven by Rising Diabetes and Obesity Rates - September 2, 2025

- Gift Cards Market Size to Achieve USD 3.81 Trillion by 2034, Driven by Digital Payments and E-Commerce Growth - September 1, 2025

- Surgical Snare Market: How AI and Minimally Invasive Surgery Are Shaping the Future - September 1, 2025